For Week Ending November 15, 2025

For Week Ending November 15, 2025

The U.S. housing supply gap reached 3.8 million units in 2024, according to an analysis by Realtor®.com. For the first time since 2016, new construction outpaced household formations, with more than 1.6 million units completed last year, the highest level in nearly two decades. While builders are making progress, it would still take about 7.5 years to close the housing gap at the 2024 pace of construction.

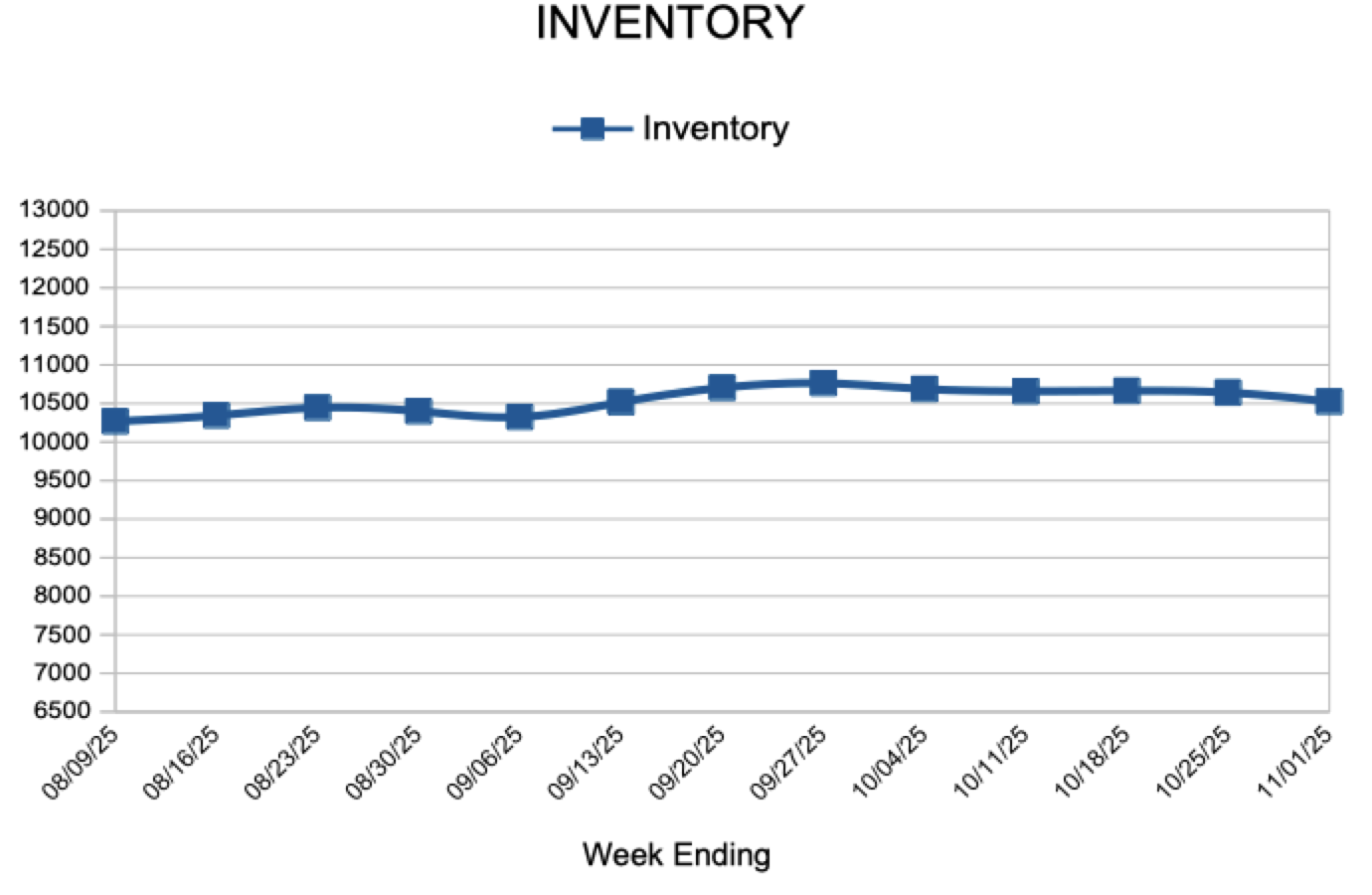

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 15:

- New Listings increased 0.7% to 1,022

- Pending Sales decreased 1.8% to 774

- Inventory increased 0.8% to 10,190

FOR THE MONTH OF OCTOBER:

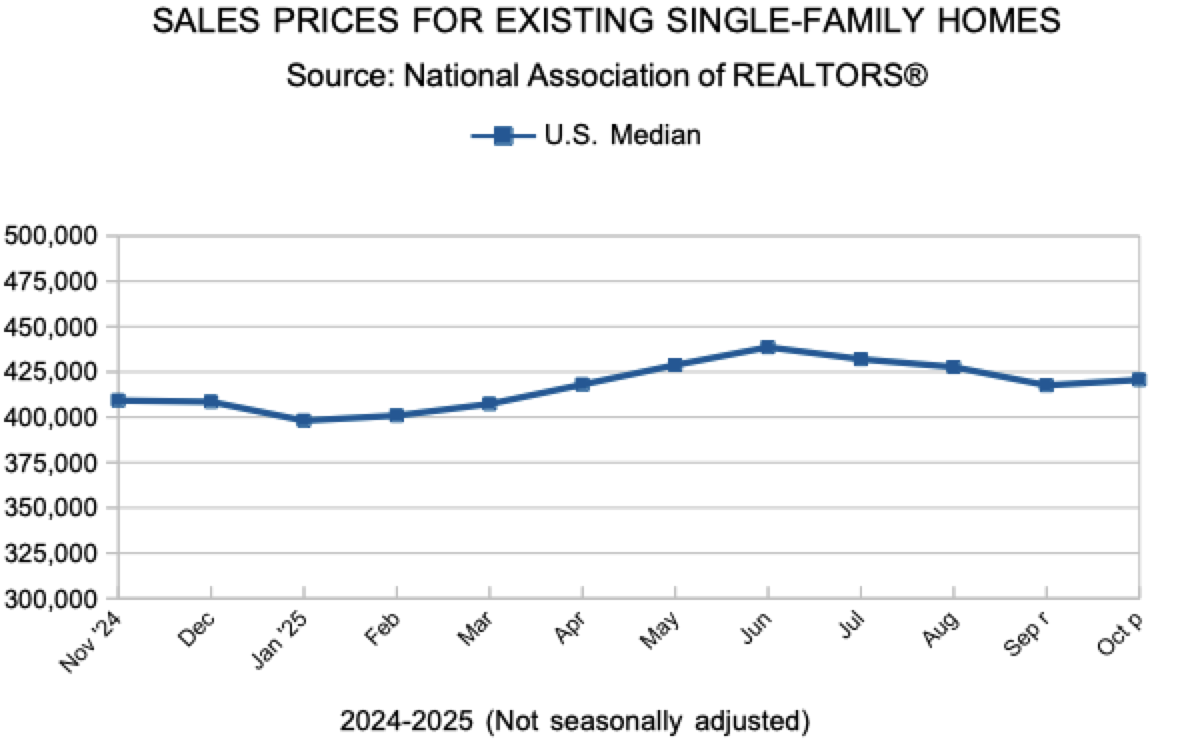

- Median Sales Price increased 2.1% to $389,900

- Days on Market increased 6.7% to 48

- Percent of Original List Price Received increased 0.3% to 98.1%

- Months Supply of Homes For Sale decreased 3.6% to 2.7

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.