Weekly Market Report

For Week Ending February 3, 2024

For Week Ending February 3, 2024

U.S. single-family rent growth was up 2.7% year-over-year as of last measure, according to Corelogic’s January 2024 U.S. Single-Family Rent Index, keeping in line with the annual rate of growth recorded prior to the pandemic. Attached singlefamily rents increased 3.3% year-over-year, while detached single-family rents rose 2.3%. Nationally, rent growth was highest in the lower-priced rental tiers, climbing 2.9% year-over-year.

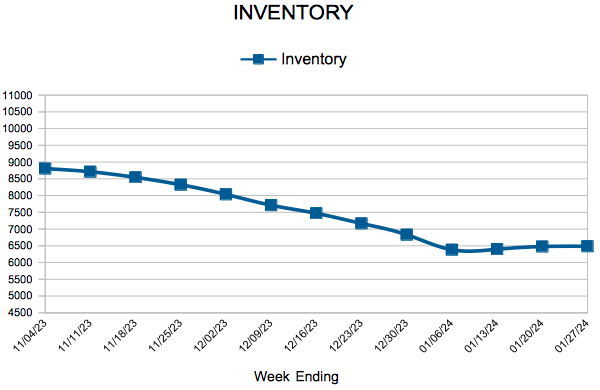

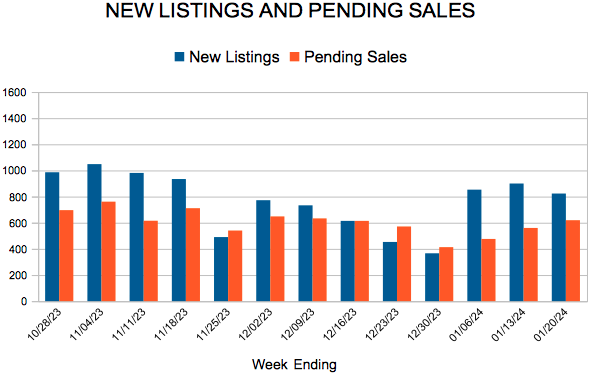

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING FEBRUARY 3:

- New Listings increased 17.9% to 942

- Pending Sales increased 4.2% to 720

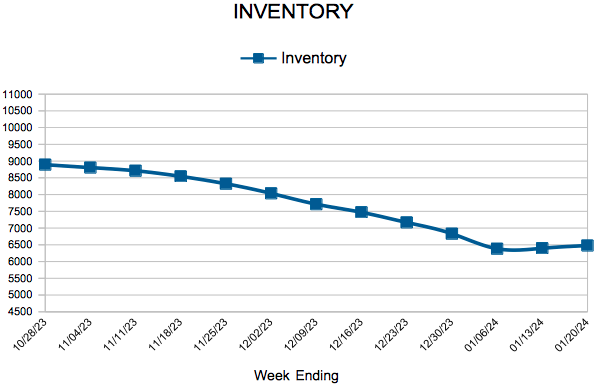

- Inventory increased 2.6% to 6,446

FOR THE MONTH OF DECEMBER:

- Median Sales Price increased increased 1.4% to $353,900

- Days on Market increased 2.0% to 51

- Percent of Original List Price Received increased 0.4% to 96.7%

- Months Supply of Homes For Sale increased 20.0% to 1.8

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

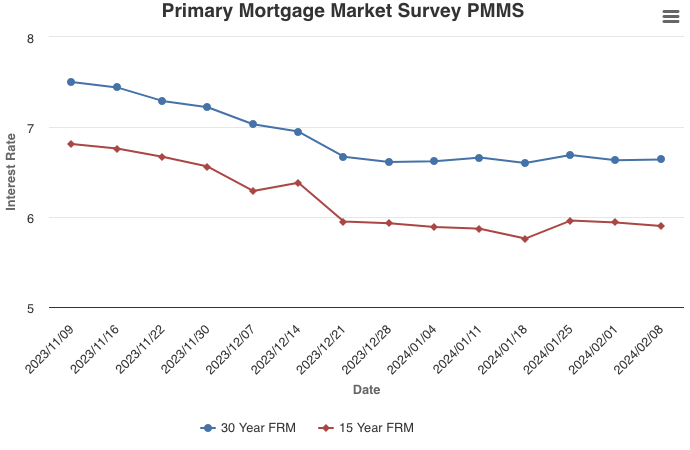

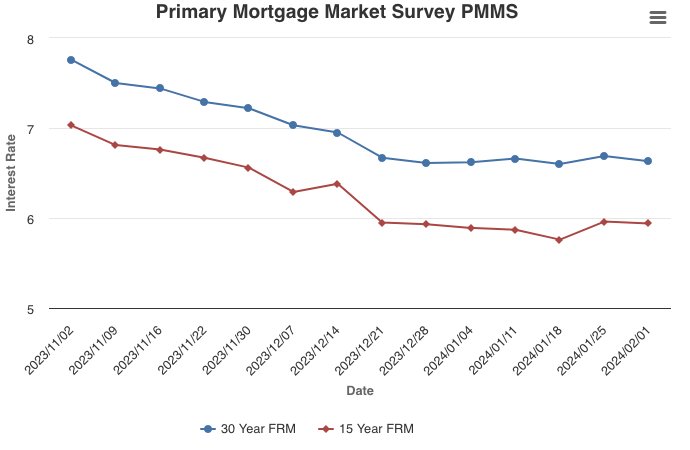

Mortgage Rates Show Little Movement

February 8, 2024

Mortgage rates remain stagnant, hovering in the mid-six percent range over the past several weeks. The economy and labor market remain strong with wage growth outpacing inflation, which is keeping consumer spending robust. Meanwhile, affordability in the housing market is an ongoing issue due to continued high home prices, elevated mortgage rates and low supply of homes on the market, particularly for first-time and low-income homebuyers.

Information provided by Freddie Mac.

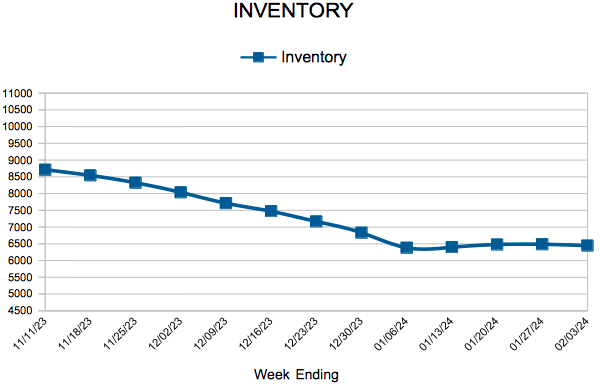

New Listings and Pending Sales

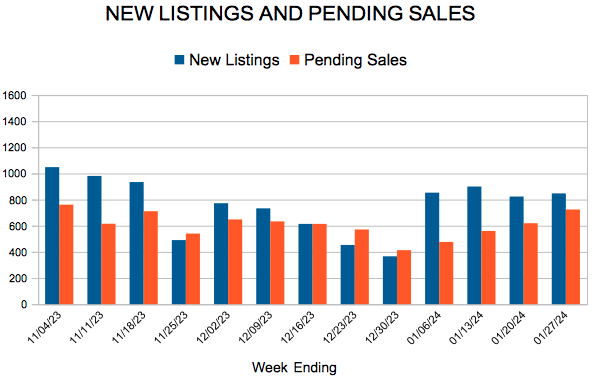

Inventory

Weekly Market Report

For Week Ending January 27, 2024

For Week Ending January 27, 2024

Builder confidence continues to rise amid declining mortgage rates, climbing seven points to 44 in January, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). The latest reading marks the highest level of confidence since last summer, with builder sentiment up nine points from the same period last year. Mortgage rates have plunged more than one full percentage point since their peak of 7.79% in October, improving affordability and helping to bring some buyers back from the sidelines.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JANUARY 27:

- New Listings increased 13.7% to 847

- Pending Sales increased 6.3% to 724

- Inventory increased 0.5% to 6,486

FOR THE MONTH OF DECEMBER:

- Median Sales Price increased 1.3% to $353,500

- Days on Market remained flat at 50

- Percent of Original List Price Received increased 0.4% to 96.7%

- Months Supply of Homes For Sale increased 20.0% to 1.8

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Tick Down

February 1, 2024

Although affordability continues to impact homeownership, the combination of a solid economy, strong demographics and lower mortgage rates are setting the stage for a more robust housing market. Mortgage rates have been stable for nearly two months, but with continued deceleration in inflation, rates are expected to decline further. The economy continues to outperform due to solid job and income growth, while household formation is increasing at rates above pre-pandemic levels. These favorable factors should provide strong fundamental support to the market in the months ahead.

Information provided by Freddie Mac.

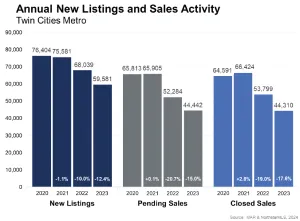

2023 Annual Twin Cities Housing Market Report

23-year high mortgage rates and rising prices increased monthly housing costs and slowed buyer activity

Minneapolis–Saint Paul, Minnesota (January 29, 2024) – After sales reached a 20-year high in 2021, sales in 2023 plunged to their lowest level since 2011. The pendulum always overswings. That decline can mostly be tied to higher interest rates along with rising prices and a shortage of housing supply. Mortgage rates rose nearly three-fold between 2021 and 2023—from 2.7% to 8.0%, and yet our region still saw record sales prices, although the pace of those gains has slowed.

2023: A Year in Review

Home sales fell for a second year in a row, according to an annual report issued by Minneapolis Area REALTORS® and the St. Paul Area Association of REALTORS®. Would-be buyers have been discouraged by a triple punch of higher mortgage rates, rising prices and low inventory. Yet, even weaker demand wasn’t enough to pressure prices lower because of the lack of available homes for sale. That meant sellers still saw reasonable offers relatively quickly—but not to the same degree as in 2021 and 2022. Aside from sales volume, in some ways, 2023 represented a return to a more normal, pre-COVID market.

- New listings were down 12.4% while pending sales were down 15.0%.

- The median price rose 1.4% while homes spent 29.0% more time on the market.

- Sales under $500,000 were down 17.0% for the year compared to a 4.0% decline for luxury homes over $1 million.

- Single family purchase agreements declined 17.2% while townhomes fell 6.2%.

- Signed contracts on new homes were up 11.3% while they were down 17.7% for existing homes.

- While newly constructed home inventory rose slightly, builders simply can’t produce enough supply—nor at the right price points—to offset the affordability and supply challenges. Builders do, however, have every incentive to sell their homes and are offering innovative ways to help buyers while existing homeowners are more reluctant to sell and trade up.

While multiple offer situations are still happening but have become less common, waiving inspections and similar tactics have become rarer. Overall, buyers were more cautious and selective throughout the year. Sellers, however, felt the “lock-in” effect where they were reluctant to relinquish their favorable mortgage rates and trade up for a higher rate on a higher priced home. And, as we know, most sellers have to turn right around and be buyers, which partly explains why the largest share of buyers since 2013 chose to leverage their equity from their last home and purchase the next in cash as opposed to contending with higher mortgage rates.

“During the year, we saw many similar trends from the second half of 2022 where higher rates began to weigh heavier on the marketplace,” said Amy Peterson, President of the Saint Paul Area Association of REALTORS®. “We saw fewer listings and fewer sales; and yet higher prices, surprisingly strong offers and relatively quick market times.”

Rate Hikes and Short Supply

The rate hikes meant less activity, but the supply shortage meant decent offers, rising prices and homes selling in a reasonable time frame—albeit longer than the previous two years. Mortgage rates are too high for prices to rise significantly, but supply is too tight for prices to fall. There’s less activity overall but the balance between that buyer and seller activity remains tight. There will always be job, family or health changes that necessitate a home sale or purchase. That’s still happening, but some buyers who wanted to move at a 3.0 or 4.0% rate but don’t have to are choosing to stay put. The Federal Reserve has signaled there’s a good chance rates come down in 2024 in response to inflation cooling, but no guarantees. It would be a welcomed reprieve for frustrated buyers.

“Given the ever-changing nature of real estate, patience, persistence, creativity around financing, and managing expectations are key ingredients to a successful transaction,” said Jamar Hardy, President of Minneapolis Area REALTORS®. “If rates do come down, a lot of pent-up demand that’s been sidelined recently will be unleashed which could lead to another frenzied market with listings selling for over asking price. Whatever happens, it’s critical to work with a qualified market expert to navigate these complexities.”

Impact of Higher Mortgage Rates

Ultimately, residential real estate mostly boils down to monthly payments. That’s where affordability comes in. Relatively few homebuyers pay cash; most take out a mortgage with monthly payments. In that sense, monthly payments matter more than price. In fact, if you downsized to a less costly home last year there’s a chance your payments still rose. Enough well-paying jobs are key to sustaining the monthly payments, upkeep of and demand for homes. That’s why in the short term, rates matter. But in the long run, it’s the economy and labor market that determine the long-term health and sustainability of the housing market.

Since 2020, the typical payment on the median priced home has risen from around $1,600 per month to $2,700 per month. Even as income growth has accelerated over the last few years, that jump is too large a hurdle for too many Minnesotans. Committing a larger share of a household budget to housing also means less discretionary spending elsewhere in the economy, which is a key contributor to economic and job growth. Housing affects the economy, and the economy affects housing.

The impact of higher rates has rippled throughout virtually every corner of the marketplace. Compared to 2022, homes are taking longer to sell (40 vs. 31 days), sellers are accepting less of their asking price (99.3% vs. 100.9%) and absorption rates have risen (1.9 months vs. 1.5). But because the last several years were so unique, it’s worth comparing 2023 to 2019. When compared to 2019, home sales in 2023 were down 26.0% and new listings shrank 21.8%. While market times were up compared to 2022, homes sold more quickly than in 2019 and 2020. Although sellers received on average 99.3% of their list price for the year, they accepted 96.6% in December.

Market Activity by Region

“The [Twin] Cities are wonderful, but we also have an entire state that offers all sorts of different homeownership opportunities,” according to Geri Theis, President of Minnesota Realtors®. “Greater Minnesota offers something for everyone. But too many felt excluded from homeownership due to affordability challenges and we must continue working to change that.” Rural broadband, affordable childcare, education and a labor shortage remain thorny obstacles. “While it was undeniably a challenging year for buyers, over 60,000 Minnesotans were able to close on a home across our great state,” Theis continued.

Market activity always varies by geography, price point and market segment. For example, a large $600,000 single family home in Eden Prairie doesn’t affect a Duluth condo selling for $195,000 or a Brainerd cabin selling for $350,000. And with the rise of remote work, many Minnesotans can telecommute from outside the metro and reside on a lake in a more rural area, for example.

December pending sales—a measure of future demand—rose 8.7% statewide compared to a 3.7% increase in the metro. Home prices rose 3.3% for the month statewide versus 1.1% in just the Twin Cities. Both the metro and the state have below average unemployment rates and above average incomes. Challenges persist, but Minnesota seems well positioned. As inflation continues to cool and the economy remains stable, the rate environment should ease. That could incentivize more demand that would still be faced with a shortage of supply. It should make for an interesting year.

2023 by the Numbers | Compared to 2022

-

- Sellers listed 59,581 properties on the market, a 12.4% decrease from 2022

- Buyers closed on 44,310 properties, down 17.6%

- The Median Sales Price rose 1.4% to $368,000

- Inventory levels fell 4.9% to 6,270 units as of year-end

- Months’ Supply of Inventory was up 26.7% to 1.9 months of supply (5-6 months is balanced)

- Days on Market increased 29.0% to 40 days, on average (median of 18, up 28.6%)

- Changes in Sales activity varied by market segment

- Single family sales were down 20.0%; condos fell 12.8%; townhomes decreased 9.1%

- Previously owned sales declined 19.2%; new construction sales fell 3.9%

- $1M+ luxury sales shrank 8.0% but remain near record highs (up 19.3% in December)

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 29

- 30

- 31

- 32

- 33

- …

- 94

- Next Page »