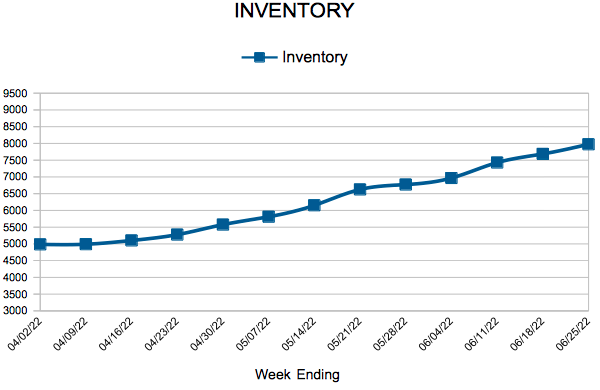

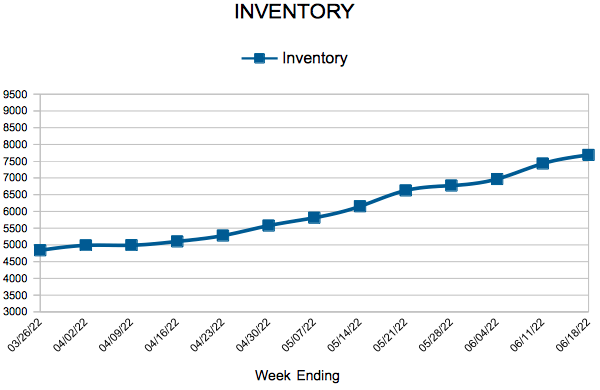

Inventory

Weekly Market Report

For Week Ending June 25, 2022

For Week Ending June 25, 2022

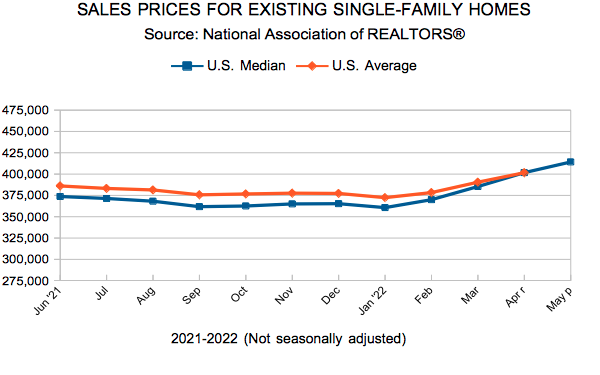

Skyrocketing rents and surging homeownership costs are forcing many prospective buyers to remain in the rental market. With the national median existing-home price recently exceeding $400,000, and assuming a down payment of 3.5%, buyers would need to come up with $14,000 down toward the typical median-priced home. That’s a significant challenge for millions of renters, whom have a median savings of $1,500 or less, according to Harvard researchers’ State of the Nation’s Housing 2022 report.

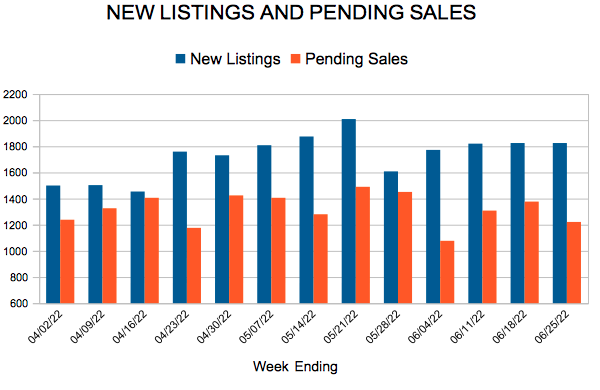

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JUNE 25:

- New Listings decreased 4.5% to 1,825

- Pending Sales decreased 25.0% to 1,221

- Inventory increased 6.8% to 7,974

FOR THE MONTH OF MAY:

- Median Sales Price increased 9.0% to $375,000

- Days on Market decreased 4.2% to 23

- Percent of Original List Price Received increased 0.1% to 104.1%

- Months Supply of Homes For Sale increased 27.3% to 1.4

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

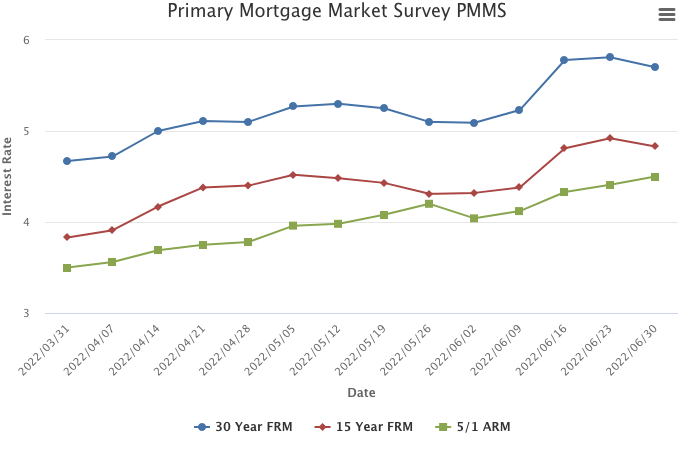

Mortgage Rates Pause from their Ascent

June 30, 2022

The rapid rise in mortgage rates has finally paused, largely due to the countervailing forces of high inflation and the increasing possibility of an economic recession. This pause in rate activity should help the housing market rebalance from the breakneck growth of a seller’s market to a more normal pace of home price appreciation.

Information provided by Freddie Mac.

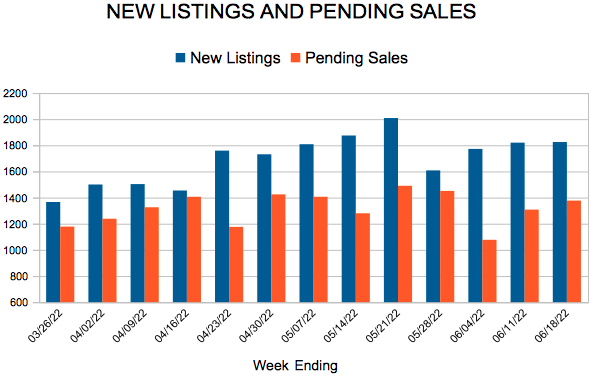

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending June 18, 2022

For Week Ending June 18, 2022

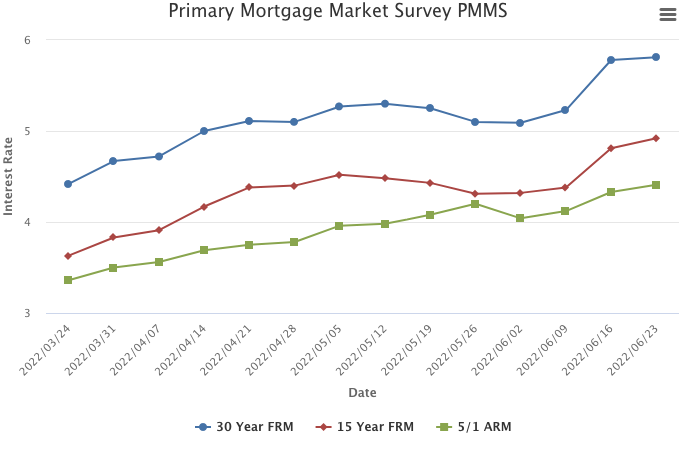

The 30-year fixed rate mortgage averaged 5.78% the week ending 6/17, rising 55 basis points from the previous week and marking the largest one week increase since 1987, according to Freddie Mac. Mortgage rates are nearly double compared to this time last year, with rates spiking following the Federal Reserve’s recent decision to raise the benchmark interest rate by three quarters of a percentage point in order to help quash rising inflation.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JUNE 18:

- New Listings decreased 14.6% to 1,825

- Pending Sales decreased 11.6% to 1,377

- Inventory increased 7.8% to 7,687

FOR THE MONTH OF MAY:

- Median Sales Price increased 9.0% to $375,000

- Days on Market decreased 4.2% to 23

- Percent of Original List Price Received increased 0.1% to 104.1%

- Months Supply of Homes For Sale increased 27.3% to 1.4

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Continue to Move Up

June 23, 2022

Fixed mortgage rates have increased by more than two full percentage points since the beginning of the year. The combination of rising rates and high home prices is the likely driver of recent declines in existing home sales. However, in reality many potential homebuyers are still interested in purchasing a home, keeping the market competitive but leveling off the last two years of red-hot activity.

Information provided by Freddie Mac.

May Monthly Skinny Video

Existing Home Sales

- « Previous Page

- 1

- …

- 79

- 80

- 81

- 82

- 83

- …

- 107

- Next Page »