January 12, 2023

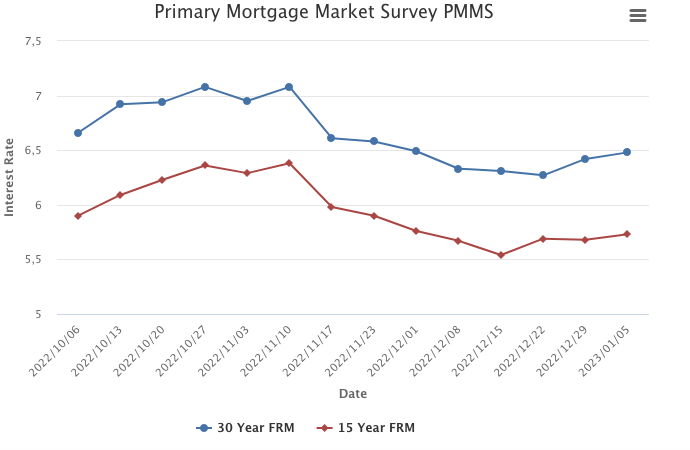

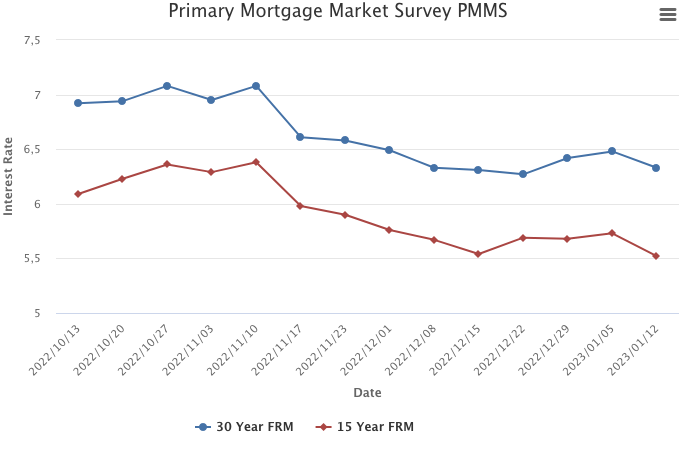

While mortgage rates have resumed their decline, the market remains hypersensitive to rate movements, with purchase demand experiencing large swings relative to small changes in rates. Over the last few weeks latent demand has been on display with buyers jumping in and out of the market as rates move.

Information provided by Freddie Mac.

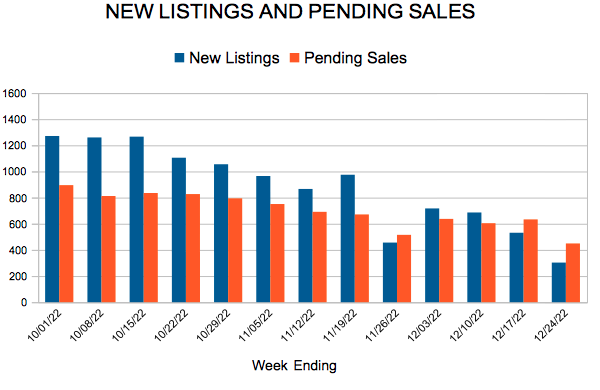

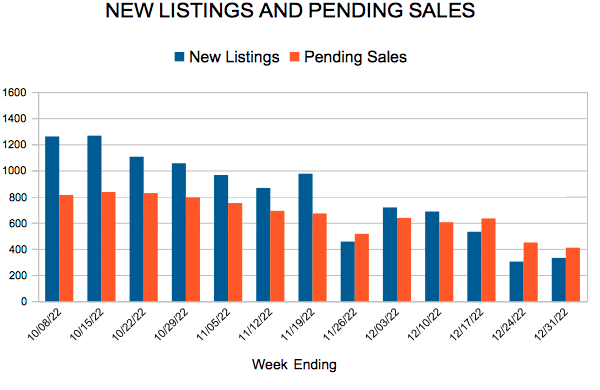

For Week Ending December 31, 2022

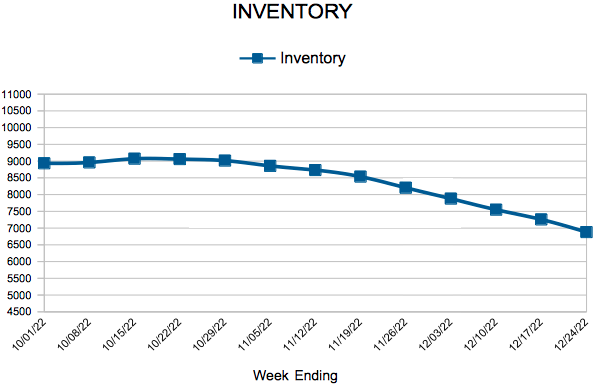

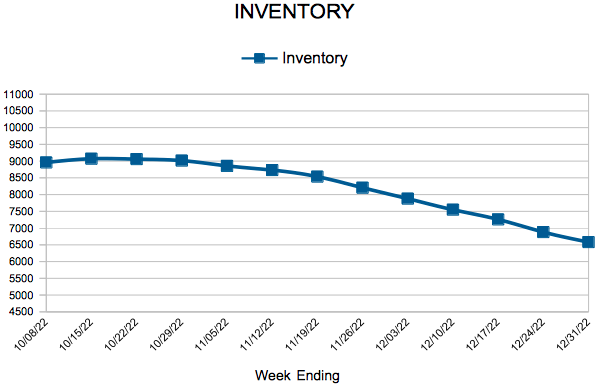

For Week Ending December 31, 2022