Weekly Market Report

For Week Ending March 18, 2023

For Week Ending March 18, 2023

More than a decade of underbuilding has resulted in a shortage of 6.5 million single-family homes, as new-home construction continues to lag population growth. According to a new report from Realtor.com, 15.6 million new households were formed between 2012 and 2022, while only 9.03 million new single-family homes were completed. However, the report acknowledges that if multi-family starts are included, which represented 35% of all housing starts in 2022, the current supply deficit falls to 2.3 million homes.

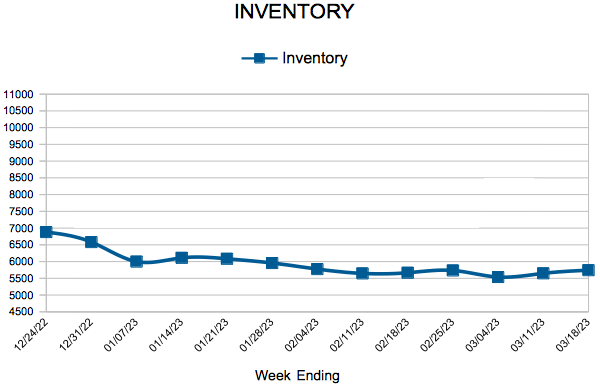

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MARCH 18:

- New Listings decreased 29.9% to 1,006

- Pending Sales decreased 27.7% to 850

- Inventory increased 10.8% to 5,743

FOR THE MONTH OF FEBRUARY:

- Median Sales Price increased 0.6% to $342,000

- Days on Market increased 38.6% to 61

- Percent of Original List Price Received decreased 3.6% to 97.2%

- Months Supply of Homes For Sale increased 44.4% to 1.3

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending March 11, 2023

For Week Ending March 11, 2023

The slower pace of home sales has helped housing supply increase at a record pace nationwide, with inventory climbing 67.8% year-over-year in February, according to Realtor.com’s latest Monthly Housing Market Trends report. Inventory was up in 49 out of 50 of the largest US metros, driven largely by increased time on market and a decrease in buyer demand due to elevated borrowing costs. February marks the 6th consecutive month the supply of homes increased, although inventory remains down compared to pre-pandemic levels.

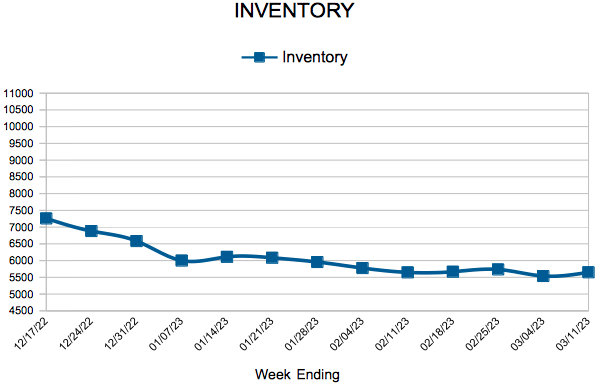

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MARCH 11:

- New Listings decreased 25.8% to 1,011

- Pending Sales decreased 31.7% to 804

- Inventory increased 10.4% to 5,649

FOR THE MONTH OF FEBRUARY:

- Median Sales Price increased 0.5% to $341,850

- Days on Market increased 38.6% to 61

- Percent of Original List Price Received decreased 3.6% to 97.2%

- Months Supply of Homes For Sale increased 44.4% to 1.3

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending March 4, 2023

For Week Ending March 4, 2023

According to recent data from Black Knight, more than 40% of US mortgages originated in 2020 – 2021, with almost 25% of all current home loans originating in 2021, when the pandemic helped mortgage rates tumble to historic lows. What’s more, nearly 65% of mortgages are at rates of 4% or below, offering little incentive for many current homeowners to sell their homes now that borrowing costs are significantly higher.

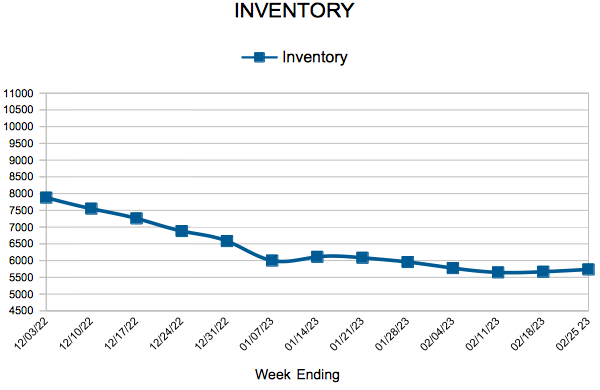

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MARCH 4:

- New Listings decreased 23.2% to 1,126

- Pending Sales decreased 36.1% to 751

- Inventory increased 11.3% to 5,539

FOR THE MONTH OF JANUARY:

- Median Sales Price increased 2.7% to $342,000

- Days on Market increased 46.3% to 60

- Percent of Original List Price Received decreased 3.6% to 96.0%

- Months Supply of Homes For Sale increased 55.6% to 1.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending February 25, 2023

For Week Ending February 25, 2023

According to a recent National Association of Home Builders/Wells Fargo Housing Market Index (HMI) survey, building material prices were the most significant issue for US homebuilders last year, with 96% of builders reporting that building material prices were a problem. Availability of building materials and cost and availability of labor also ranked among the largest problems builders faced in 2022, along with rising inflation and higher interest rates, both of which remain top concerns this year for the majority of builders surveyed.

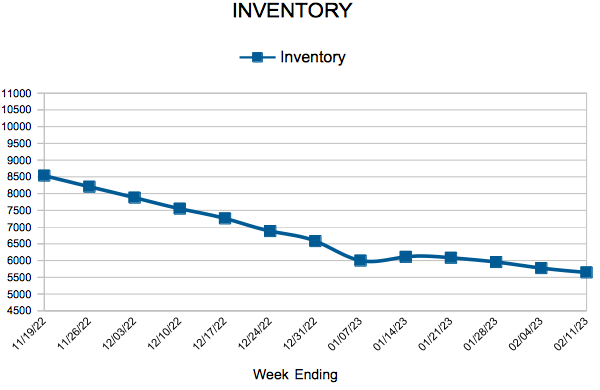

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING FEBRUARY 25:

- New Listings decreased 35.3% to 743

- Pending Sales decreased 23.5% to 744

- Inventory increased 15.1% to 5,735

FOR THE MONTH OF JANUARY:

- Median Sales Price increased 2.7% to $342,000

- Days on Market increased 46.3% to 60

- Percent of Original List Price Received decreased 3.6% to 96.0%

- Months Supply of Homes For Sale increased 55.6% to 1.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending February 11, 2023

For Week Ending February 11, 2023

Nationally, the median age of owner-occupied homes is 40 years, according to the 2021 American Community Survey (ACS), the most recent survey available. Among owner-occupied homes, nearly half were built before 1979, while only 10% of homes were built 2010 or later. As America’s housing stock continues to age, and with a limited supply of residential new construction available, the home renovation industry has experienced a boom the last few years, especially during the pandemic, which saw homeowner remodeling and repair spending increase by double digits, per the Leading Indicator of Remodeling Activity (LIRA) from the Harvard Joint Center for Housing Studies.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING FEBRUARY 11:

- New Listings decreased 22.0% to 855

- Pending Sales decreased 22.6% to 713

- Inventory increased 15.1% to 5,647

FOR THE MONTH OF JANUARY:

- Median Sales Price increased 2.7% to $342,000

- Days on Market increased 46.3% to 60

- Percent of Original List Price Received decreased 3.6% to 96.0%

- Months Supply of Homes For Sale increased 44.4% to 1.3

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 26

- 27

- 28

- 29

- 30

- …

- 47

- Next Page »