Weekly Market Report

For Week Ending November 25, 2023

For Week Ending November 25, 2023

Down payments reached a new high recently, as rising interest rates, elevated sales prices, and increased competition have led homebuyers to put more money down when purchasing a home. According to Realtor.com, buyers made an average down payment of 14.7% of the purchase price and a median down payment of $30,400 on primary residences in the third quarter of the year, surpassing the previous high of 14.1% in Q2 2022. In doing so, buyers paid 78.2% more as a down payment in Q3 2023 compared to Q1 2020, when the median down payment was $17,000.

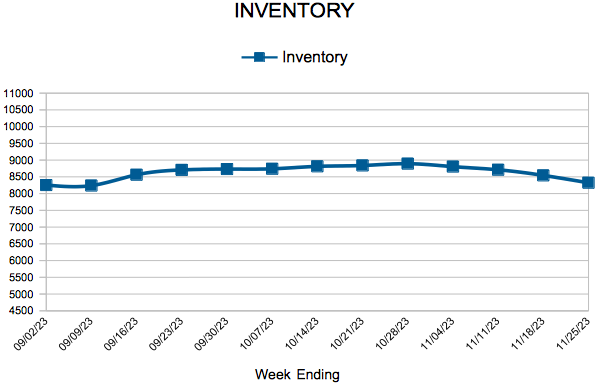

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 25:

- New Listings increased 5.6% to 490

- Pending Sales increased 4.4% to 540

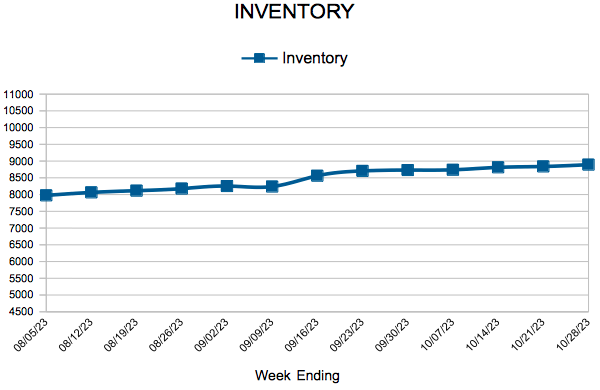

- Inventory decreased 4.6% to 8,323

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 2.4% to $365,000

- Days on Market increased 2.8% to 37

- Percent of Original List Price Received increased 0.2% to 98.4%

- Months Supply of Homes For Sale increased 20.0% to 2.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending November 18, 2023

For Week Ending November 18, 2023

U.S. home seller profits continue to rise, with profit margins on median-priced single-family home and condo sales climbing to 59% in the third quarter of the year, up from 56.6% in the second quarter of 2023, according to ATTOM’s Q3 2023 U.S. Home Sales Report. Typical profit margins increased from the second quarter to the third quarter of 2023 in 85 of 155 metropolitan statistical areas analyzed, although profits were down year-over-year in 103, or 66%, of those metro areas.

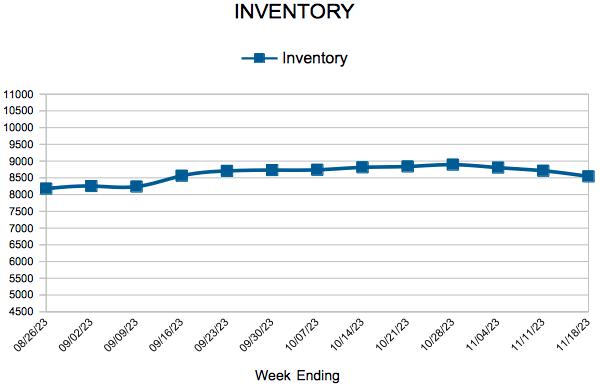

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 18:

- New Listings decreased 5.9% to 934

- Pending Sales increased 3.6% to 711

- Inventory decreased 5.4% to 8,543

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 2.4% to $365,000

- Days on Market increased 2.8% to 37

- Percent of Original List Price Received increased 0.2% to 98.4%

- Months Supply of Homes For Sale increased 20.0% to 2.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending November 11, 2023

For Week Ending November 11, 2023

Despite sluggish home sales, US home prices have continued to increase, further impacting affordability for many prospective buyers. According to the latest S&P CoreLogic Case-Shiller Index, home prices were up 2.6% year-over-year and 0.4% month-over-month as of last measure, marking the seventh consecutive monthly increase. Additionally, the Federal Housing Finance Agency’s index found home prices increased 5.6% year-over-year and 0.6% month-over-month as of last measure.

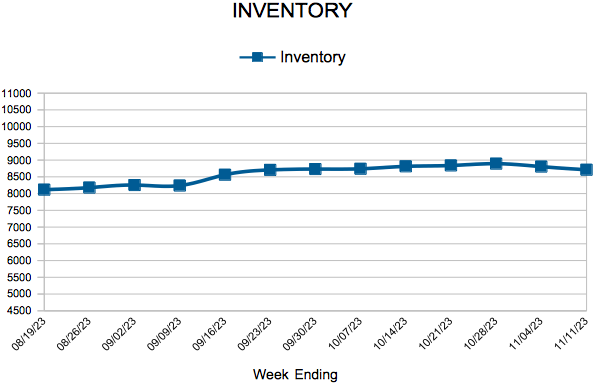

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 11:

- New Listings increased 12.0% to 981

- Pending Sales decreased 13.1% to 615

- Inventory decreased 5.3% to 8,711

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 2.4% to $365,000

- Days on Market increased 2.8% to 37

- Percent of Original List Price Received increased 0.2% to 98.4%

- Months Supply of Homes For Sale increased 20.0% to 2.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending November 4, 2023

For Week Ending November 4, 2023

Builder confidence continues to wane amid persistently high mortgage rates, which have remained above 7% since mid-August. According to the National Association of Home Builders, builder confidence in newly built single-family homes fell four points to 40 in October, marking the third consecutive monthly decline. Higher rates have priced many prospective buyers out of the market, while also driving up the cost of builder development and construction loans, further impacting supply and housing affordability.

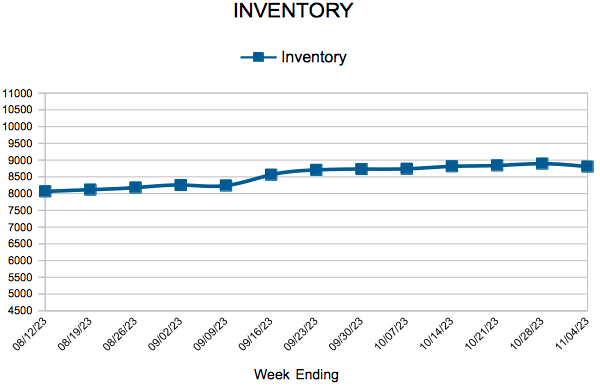

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 4:

- New Listings increased 6.6% to 1,048

- Pending Sales remained flat at 761

- Inventory decreased 5.8% to 8,805

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.4% to $371,000

- Days on Market increased 6.3% to 34

- Percent of Original List Price Received increased 0.4% to 99.3%

- Months Supply of Homes For Sale increased 20.0% to 2.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending October 28, 2023

For Week Ending October 28, 2023

Elevated mortgage rates have surpassed high home prices as the primary barrier to housing affordability, according to Fannie Mae’s latest Home Price Sentiment Index (HPSI), which fell by 2.4 points to 64.5 in September. The monthly decrease in HPSI was attributed to net decreases in 5 of the Index’s 6 components—Buying Conditions, Selling Conditions, Mortgage Rate Outlook, Job Loss Concern, and Change in Household Income—with the majority of consumers reporting that they expect mortgage rates will continue to rise over the next 12 months.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING OCTOBER 28:

- New Listings decreased 9.1% to 986

- Pending Sales decreased 13.2% to 696

- Inventory decreased 6.3% to 8,893

FOR THE MONTH OF SEPTEMBER:

- Median Sales Price increased 2.4% to $371,000

- Days on Market increased 6.3% to 34

- Percent of Original List Price Received increased 0.4% to 99.3%

- Months Supply of Homes For Sale increased 20.0% to 2.4

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 3

- 4

- 5

- 6

- 7

- …

- 31

- Next Page »