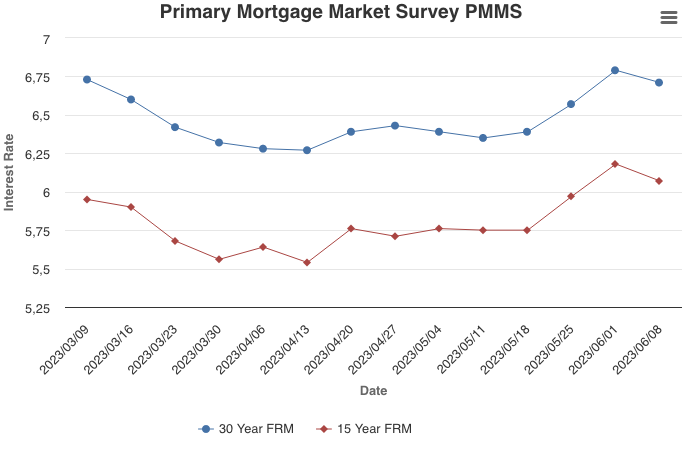

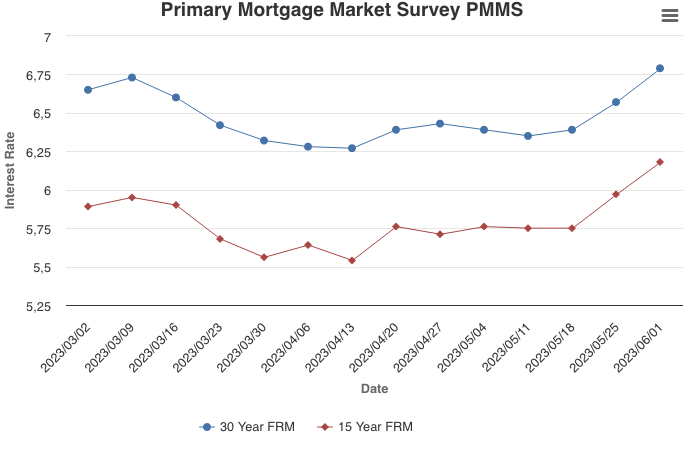

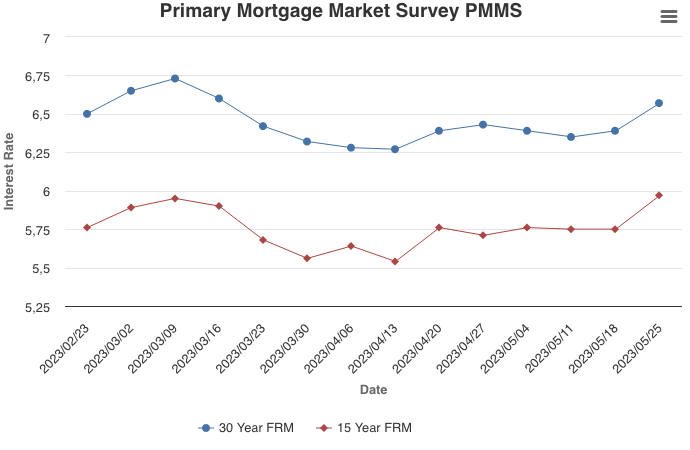

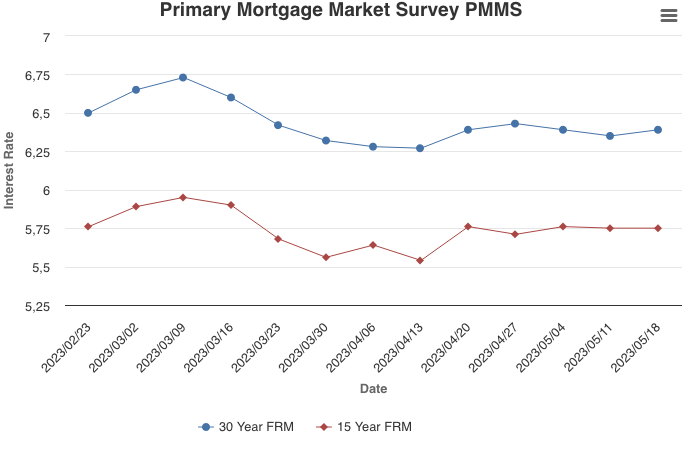

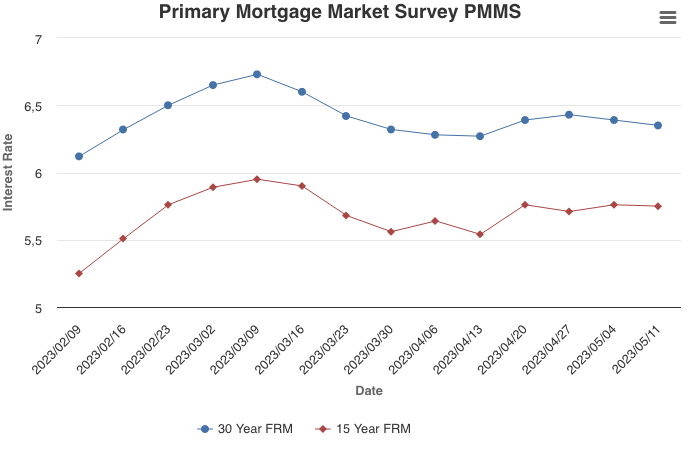

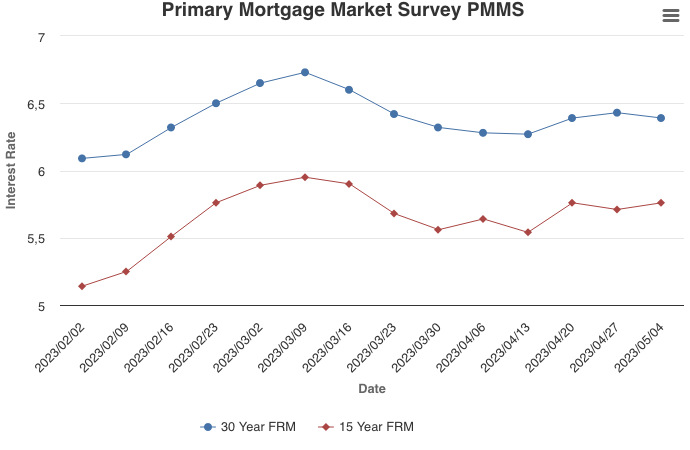

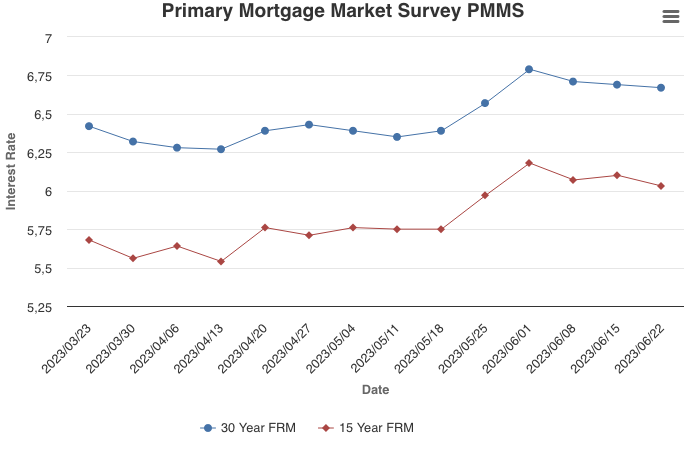

June 22, 2023

Mortgage rates slid down again this week but remain elevated compared to this time last year. Potential homebuyers have been watching rates closely and are waiting to come off the sidelines. However, inventory challenges persist as the number of existing homes for sale remains very low. Though, a recent rebound in single-family housing starts is an encouraging development that will hopefully extend through the summer.

Information provided by Freddie Mac.