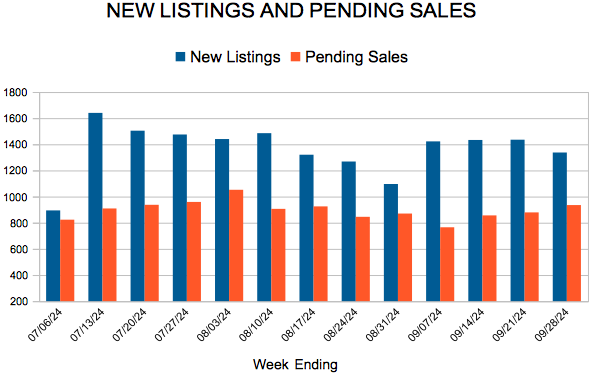

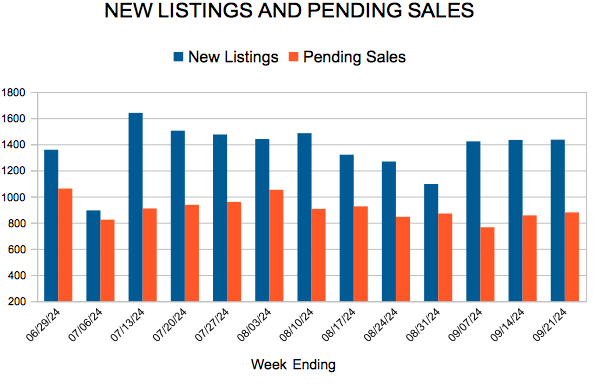

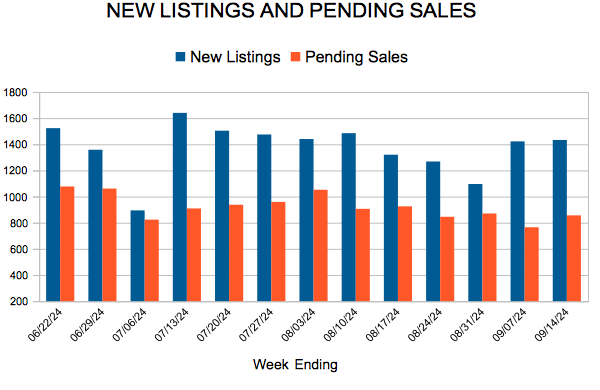

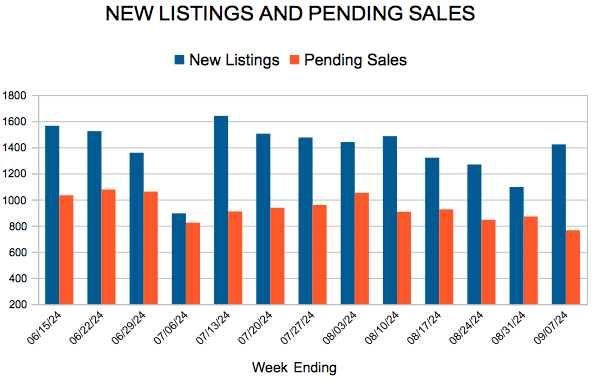

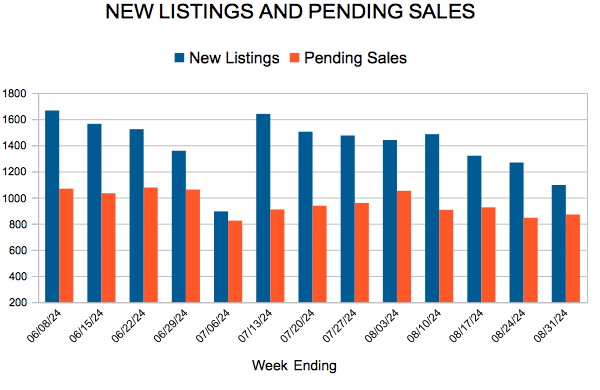

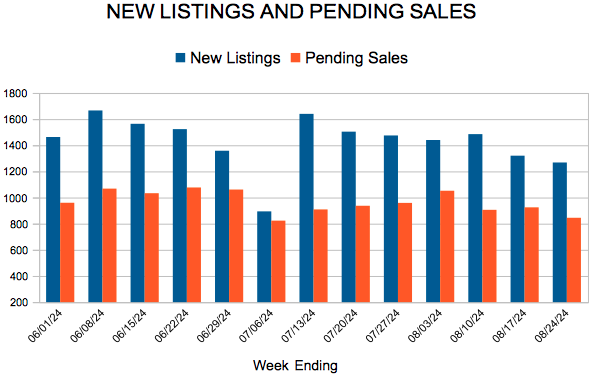

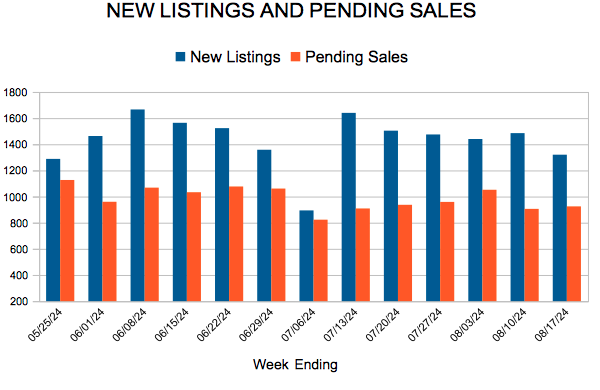

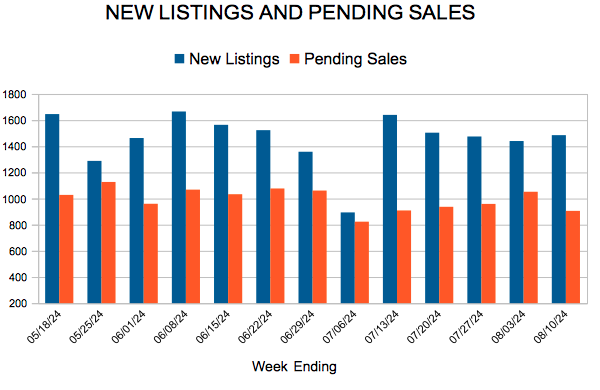

New Listings and Pending Sales

New Listings and Pending Sales

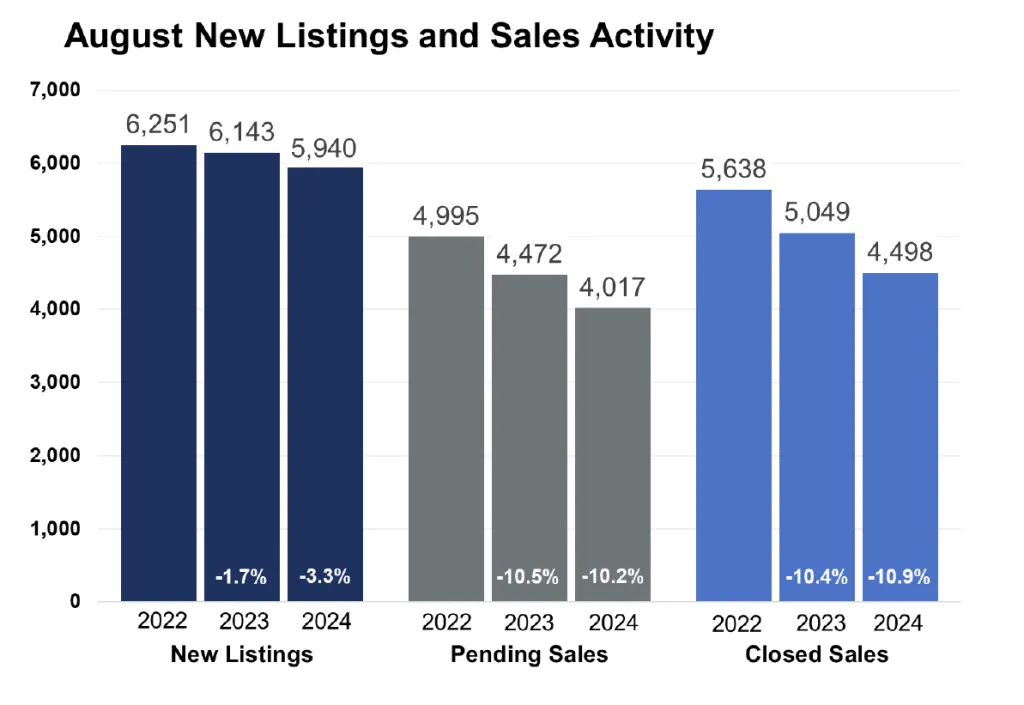

August Housing Market Update

Buyer and seller activity down from last August, but lower rates on the way

- Pending sales fell 10.2%; new listings down 3.3%

- The median sales price increased 2.6% to $389,700

- Market times rose 21.2% to 40 days; inventory up 11.7% to 9,712

(Sep. 17, 2024) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, seller activity softened along with buyer activity. Inventory and prices were higher.

Sellers, Buyers and Housing Supply

$2,820. That’s what a homeowner would save per year if they purchased or refinanced the median-priced home in August compared to if they purchased it when rates were at their peak in late 2023. Assuming 20.0% down, the monthly payment on a $389,700 home decreased from $2,790 to $2,555 per month when comparing August interest rates to when they were at their peak. At today’s mid-September rate of 6.1%, that payment drops even further to $2,474. That includes principal, interest, taxes and insurance. It’s a good representation of real monthly costs outside of maintenance and repairs. And that $2,820 in annual savings amounts to about 2.3% of the median family income in the metro.

Those lower rates need some time to course through the system before impacting demand. For August, pending sales were down 10.2% but are only down 0.7% for the year. Seller activity was also lower; new listings fell 3.3% but are actually up 8.5% for the year. Homes took more time to sell. At an average of 40 days, market times were up 21.2% for the month but are only 7.3% higher compared to 2023 year-to-date. Buyers thirsty for more inventory will benefit from an 11.7% increase in the number of homes for sale. That figure has now risen for ten straight months. Unfortunately, that inventory isn’t necessarily at the price points or in the locations today’s home buyers want or need.

Prognosticators are already discussing Spring market 2025. The rate environment should continue to improve, but a significant backlog of pent-up demand could overwhelm even the inventory growth we’ve seen. Unleashing that demand could also mean buyers once again find themselves in multiple-offer situations writing contracts for over list price. “The biggest hurdle is affordability; the other big hurdle has been supply,” said Jamar Hardy, President of Minneapolis Area REALTORS®. “The trend in mortgage rates is promising, but it will take time to fix our long-term housing shortage.”

Prices, Market Times and Negotiations

Prices are still rising but at a more subdued pace. The market-wide median sales price rose to $389,700, but the existing single-family median price is $410,000 and new single-family homes fetched $535,000. Overall, sellers accepted offers at 98.7% of their list price on average. Single-family sellers got 99.0% while condos were closer to 96.0%. Despite a metro-wide average of 40 days, single-family homes spent 37 days on market while condos spent 74. ““There’s more variation across different areas and price points than most would expect,” said Amy Peterson, President of the Saint Paul Area Association of REALTORS®. “Lower interest rates could result in quicker market times and stronger offers, so a drop in rates could cancel out any inventory gains.”

Location & Property Type

Market activity always varies by location and segment. Despite the new home market being better supplied, new home sales underperformed existing home sales. And despite better affordability, condo sales fell nearly twice as much as single family. Sales over $500,000 performed better than sales under $500,000 as higher-end buyers are less rate-sensitive. Cities such as Centerville, Dellwood, St. Bonifacius and Minnetrista had among the largest sales gains while Stacy, Ham Lake and Elko New Market all had notably weaker demand. For cities with at least three sales, the highest priced areas were Afton, Woodland, Excelsior, Wayzata and Orono while the most affordable areas were Rush City, Elko New Market, Osseo and Oakdale.

August 2024 Housing Takeaways (compared to a year ago)

- Sellers listed 5,940 properties on the market, a 3.3% decrease from last August

- Buyers signed 4,017 purchase agreements, down 10.2% (4,498 closed sales, up 13.8%)

- Inventory levels increased 11.7% to 9,712 units

- Month’s Supply of Inventory rose 13.0% to 2.6 months (4-6 months is balanced)

- The Median Sales Price was up 2.6% to $389,700

- Days on Market rose 21.2% to 40 days, on average (median of 20 days, up 33.3%)

- Changes in Pending Sales activity varied by market segment and price point

- Single family sales fell 7.9%; condo sales were down 14.0%; townhouse sales decreased 16.3%

- Traditional sales were down 9.7%; foreclosure sales declined 23.4% to 36; short sales rose 28.6% to 9

- Previously owned sales decreased 8.8%; new construction sales were down 16.6%

- Sales under $500,000 declined 11.4%; sales over $500,000 fell 4.0%

New Listings and Pending Sales

New Listings and Pending Sales

New Listings and Pending Sales

New Listings and Pending Sales

New Listings and Pending Sales

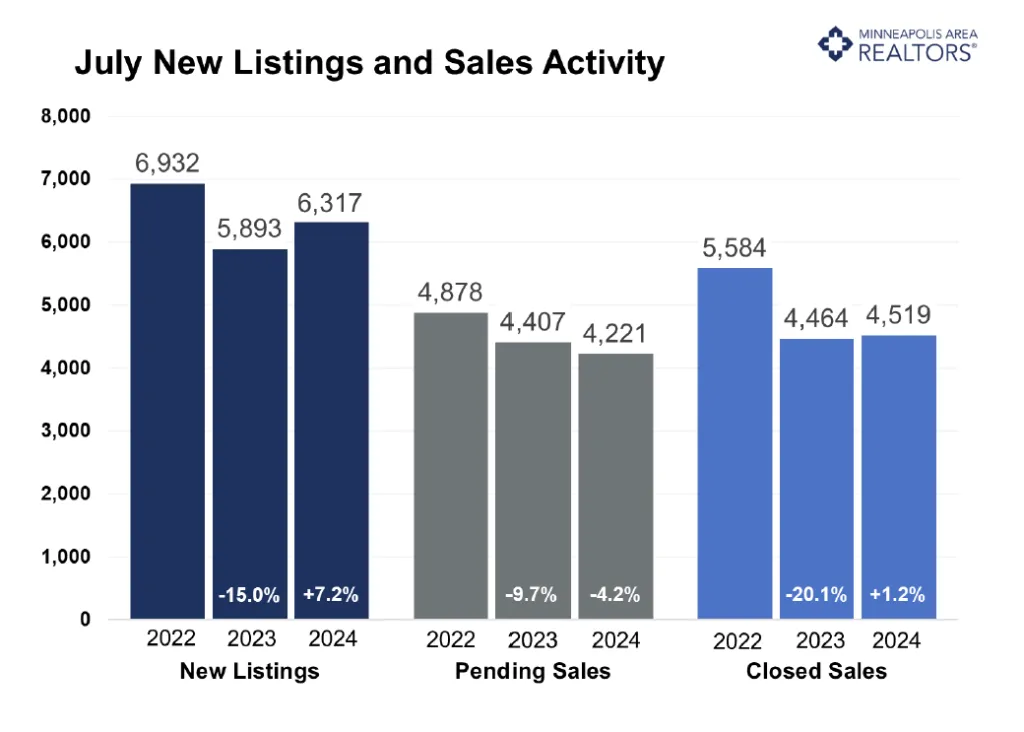

July Housing Market Update

- Signed purchase agreements fell 4.2%; new listings up 7.2%

- The median sales price increased 2.7% to $385,000

- Market times rose 24.1% to 36 days; inventory up 11.4% to 9,398

(August 15, 2024) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, seller activity rose in July compared to last year while buyers pulled back. Inventory and prices were higher.

Sellers, Buyers and Housing Supply

While the first quarter of 2024 was off to a good start, the second quarter was weaker. Homes were selling faster in January, February and March than last year. But homes were selling slower than a year ago in May, June and July. Sellers got stronger offers in January, February and March compared to last year. But then sellers accepted a smaller share of their list price in April, May, June and July. So, it’s important to put the current month’s activity for July in context. January and February of this year, for example, were abnormally warm, which allowed for more showings and sales. April, May and June all had higher than expected mortgage rates, which held back sales activity. Because of those variable factors and how they cloud apples-to-apples comparisons, it’s useful to assess market health based on a variety of time frames. To demonstrate, pending sales were down 4.2% for July but are up about 1.0% for the year. Market times were up 24.1% in July but are only up 4.8% so far this year.

Overall, seller activity has been rising modestly while buyer activity is relatively flat to up slightly for the year so far. That has also meant more inventory—also known as active listings or the number of homes for sale. But the inventory isn’t necessarily in the price buckets today’s home buyers want and need, and they may not be in the preferred market segment or location. Plus, it’s still squarely a seller’s market although not for all areas, segments or price points. Higher interest rates have stuck around, though there’s good evidence that will change. Most buyers (especially first-time) would agree that change can’t come soon enough as they’re still feeling the triple punch of rising prices, low inventory and higher mortgage rates. Plus, they lack the equity to use as a downpayment on the next home. There is a good amount of pent-up demand waiting for the affordability picture to improve. One concern is that as rates ease, demand will be unleashed, and buyers could find themselves in multiple-offer situations writing contracts for well over list price. That higher principle can negate any savings on monthly payments from lower mortgage rates. “It may very well be worth it to stomach a temporarily higher rate for a less competitive environment,” said Jamar Hardy, President of Minneapolis Area REALTORS®. “Buyers are eager for more supply, but we’re still finding consumers to be cautious and selective.”

Prices, Market Times and Negotiations

Each area and market segment are unique. The market-wide median sales price rose to $385,000, but new single-family homes tended to fetch $540,000 while existing condos were nearer to $215,000. Overall, sellers accepted offers at 99.5% of their list price on average. That said, listings priced between $300,000-$500,000 got offers at 100.1% of list price while homes over $1M were 97.9%. Once again, all listings tended to sell in about 36 days, but new homes took closer to 76 days to sell while existing homes got offers within 31 days. Single family homes are selling after 32 days, but condos are taking 63 days. “A slight slowdown in the second quarter activity is likely to change for the better as interest rates continue to ease,” said Amy Peterson, President of the Saint Paul Area Association of REALTORS®. “But those lower rates will mean more buyers in the pipeline who’ve felt priced out of the market previously will be home shopping again. Lots of people have that same idea so offer strategies could change with a more competitive market.”

Location & Property Type

As noted, housing markets are not homogeneous. New home sales outperformed existing home sales while condo sales fell much more than single family. Sales over $500,000 performed better than sales under $500,000, as higher-end buyers are less rate-sensitive. Cities such as Columbus, Hudson, Corcoran and Hanover saw among the largest sales gains while Mounds View, Orono, Medina and Victoria all had notably weaker demand. For cities with at least five sales, the highest priced areas were Wayzata, Independence, Orono and North Oaks while the most affordable areas were Lauderdale, North St. Paul, St. Paul Park and Oakdale.

From The Skinny Blog.

- « Previous Page

- 1

- …

- 5

- 6

- 7

- 8

- 9

- …

- 28

- Next Page »