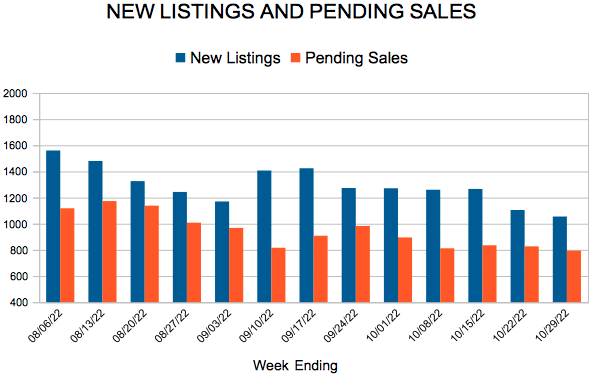

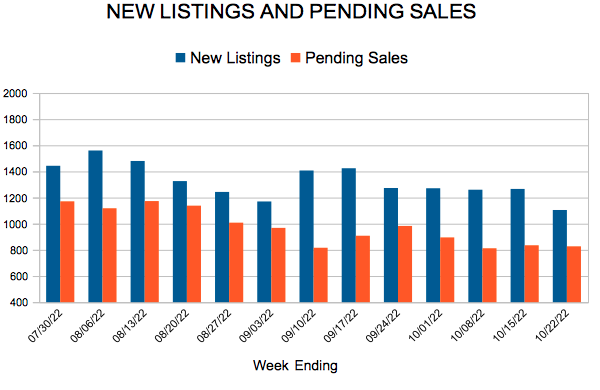

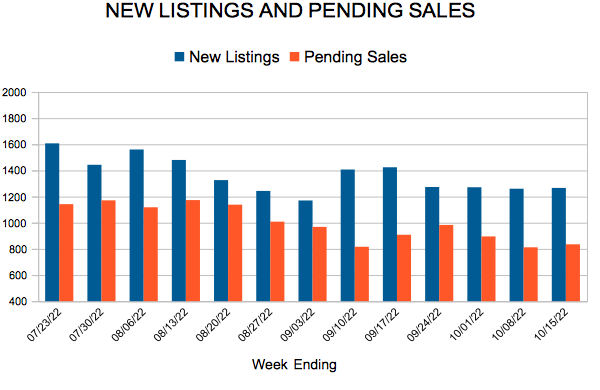

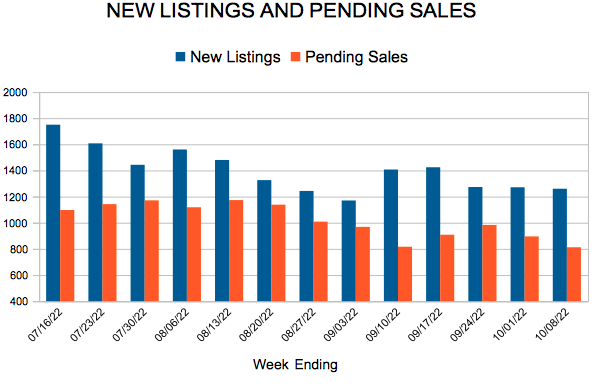

New Listings and Pending Sales

New Listings and Pending Sales

Rates push sales down further as home prices continue to grow

- Buyer activity dropped 29.7 percent for pending sales and 23.9 percent for closings

- Median sales price of Twin Cities homes rose 6.3 percent to $362,000

- Sellers received 98.9 percent of their original list price, on average

(September 16, 2022) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, pending sales were down by over a quarter in September compared to last year. Sellers also accepted a smaller share of their asking price as their listings took longer to sell. Despite this, the homes that are selling are transacting at higher price points than last year.

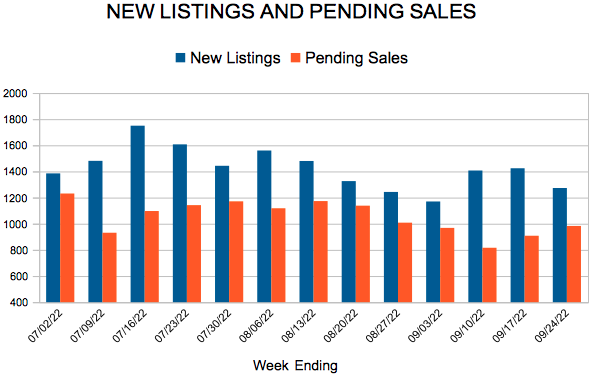

Sales & Listings

Higher mortgage rates and historically strong demand in 2021 have pushed closed home sales down by double digits for four straight months. Last month had 3,969 signed purchase agreements, 29.6 percent short of 2021 levels and the lowest September figure since 2014. As the hyper-demand from the buying frenzy of the past two years wanes, those who remain in the market have regained some leverage.

“Our buyers can pause and breathe a bit— they no longer feel compelled to skip inspection or go way over list price,” according to Denise Mazone, President of Minneapolis Area REALTORS®. “But some sellers think they’re in the same position they were in a year ago, while some buyers think they’re going to get deals like it’s 2010. As usual, the truth is somewhere in the middle.”

Seller activity was down as many sellers remain apprehensive about also becoming buyers. Softening demand has meant homes linger on the market a bit longer—31 days on average or 34.8 percent longer than last September. Fewer homeowners are willing to relinquish their interest rates and list their homes. Sellers listed 6,002 properties on the market, 17.8 percent fewer than this time in 2021. Those that did list their homes tended to accept a smaller share of their asking price. But, they get to purchase in a less frenzied market.

Inventory & Home Prices

The median home price in the Twin Cities increased by 6.3 percent to $362,000. While still up, the growth is down from double-digit price gains seen in 2020 and 2021 and is the second smallest increase in two years. Although the rate of price growth is slowing, prices remain firm and resilient in the face of declining buyer activity. Housing supply levels remain tight, despite the recent market shifts. And, the softening in demand has been accompanied by a decline in new listings, so both sides have downshifted in tandem without creating the sort of asymmetry or imbalance that could abruptly shake up prices.

“Some might see a disconnect between lower demand and strong pricing right now.” said Mark Mason, President of the Saint Paul Area Association of REALTORS®. “While prices remain firm and resilient, the rebalancing we’ve seen means sellers shouldn’t expect dozens of offers at 10 percent or more above list price on the same day they list. Buyers may feel like they have a greater likelihood of success.”

September ended with 9,002 homes for sale, only 3 more units than last year. The momentum has been shifting back towards a more balanced marketplace (4-6 months of supply), but buyers should understand we are still in a seller’s market. Month’s supply of inventory rose 18.8 percent to 1.9 months.

Location & Property Type

Market activity varies by area, price point and property type. New home sales fell 0.2 percent while existing home sales were down 24.4 percent. Single family sales fell 22.1 percent, condo sales declined 19.8 percent and townhome sales were down 26.3 percent. Sales in Minneapolis decreased 14.7 percent while Saint Paul sales fell only 10.1 percent. Cities like Pine City, Corcoran, Rush City and Delano saw the largest sales gains while Clear Lake, Centerville, St. Anthony and River Falls all had lower demand than last year.

September 2022 Housing Takeaways (compared to a year ago)

- Sellers listed 6,002 properties on the market, a 17.8 percent decrease from last September

- Buyers signed 3,964 purchase agreements, down 29.7 percent (4,860 closed sales, down 23.9 percent)

- Inventory levels were flat at 9,002 units

- Month’s Supply of Inventory rose 18.8 percent to 1.9 months (4-6 months is balanced)

- The Median Sales Price rose 6.3 percent to $362,000

- Days on Market rose 34.8 percent to 31 days, on average (median of 19 days, up 58.3 percent)

- Changes in Sales activity varied by market segment

- Single family sales decreased 22.1 percent; Condo sales were down 19.8 percent & townhouse sales fell 26.3 percent

- Traditional sales declined 23.1 percent; foreclosure sales rose 60.9 percent; short sales were up 50.0 percent (from 2 to 3)

- Previously owned sales decreased 24.4 percent; new construction sales declined 0.2 percent

New Listings and Pending Sales

New Listings and Pending Sales

New Listings and Pending Sales

New Listings and Pending Sales

Home price growth slows as market times rise and demand cools

- Median sales price was up just 5.6 percent to $369,750, the smallest gain since June 2020

- Buyer activity pulled back as pending sales fell 23.8 percent

- Homes took 26 days to sell, 18.2 percent longer than the 22 days last August

(September 16, 2022) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, both sales and listing activity were down in August while home price growth has slowed to its lowest level in two years but remains positive. Sellers also accepted lower offers as market times rose.

Inventory & Home Prices

The median home price in the Twin Cities reached $369,750 but the year-over-year growth rate is slowing. While prices are not falling, they’re not rising as quickly as they were. The 5.6 percent price growth in August is below the roughly 8.0 to 16.0 percent gains seen over the last two years. The deceleration in price growth likely reflects the pullback in demand caused by higher interest rates and economic uncertainty. Closed sales were down 20.3 percent in August compared to last year. Buyers also still face low inventory and limited options, although there’s evidence that’s changing.

“We’re seeing a less competitive landscape as the market has slowed given current interest rates,” said Denise Mazone, President of Minneapolis Area REALTORS®. “But the silver lining is that a less frenzied market could spell more inventory and opportunity for persistent buyers.”

August ended with 8,552 homes for sale, nearly flat compared to last year. Although the region is still a seller’s market, the momentum has been shifting back towards a more balanced marketplace. Month’s supply of inventory rose 13.3 percent to 1.7 months.

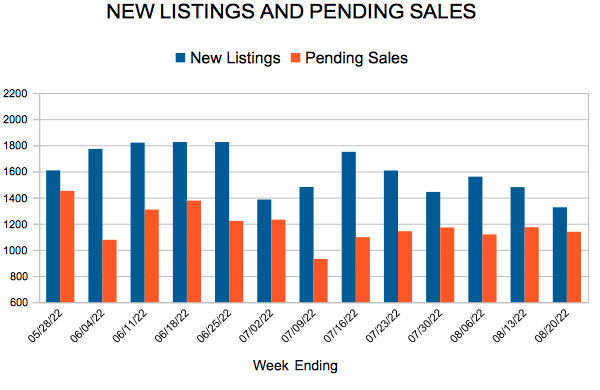

Sales & Listings

Buyer activity has softened compared to recent years. This is partly caused by higher mortgage rates, but it also reflects demand being pulled forward (i.e. sales that would’ve occurred in 2022/23 instead took place in 2020/21). August showed 4,981 signed purchase agreements, 23.8 percent short of 2021 levels and the lowest August figure since 2014. But seller activity reached its lowest level since August 2012. The easing of demand has impacted how quickly homes sell. Homes remained on market for an average of 26 days, 18.2 percent longer than last August.

“Sellers may notice that their homes are taking an extra few days to go under contract,” according to Mark Mason, President of the Saint Paul Area Association of REALTORS®. “But nobody talks about the fact that even this slower pace is still fast historically. A cooling of red-hot demand and a less intense landscape means a more sustainable and accessible marketplace.”

Sellers listed 6,186 properties on the market, 19.9 percent fewer than last August. Many Baby Boomers are choosing to age in place and aren’t listing their homes. Some homeowners are reluctant to trade into a higher mortgage rate on a higher priced home given economic uncertainty. And, some sellers are choosing to wait given their lack of options once their home sells. The industry has also underbuilt housing for about 15 years, and it will take time to rise out of that deficit.

Location & Property Type

Market activity varies by area, price point and property type. New home sales fell 11.0 percent while existing home sales were down 20.3 percent. Single family sales fell 19.7 percent, condo sales declined 26.7 percent and townhome sales were down 17.4 percent. Sales in Minneapolis decreased 23.3 percent while Saint Paul sales fell 18.9 percent. Cities like Monticello, Golden Valley, and Orono saw the largest sales gains while Stillwater, Chanhassen, and Fridley had lower demand than last year.

August 2022 Housing Takeaways (compared to a year ago)

- Sellers listed 6,186 properties on the market, a 19.9 percent decrease from last August

- Buyers signed 4,981 purchase agreements, down 23.8 percent (5,568 closed sales, down 20.3 percent)

- Inventory levels dropped 1.3 percent to 8,552 units

- Month’s Supply of Inventory rose 13.3 percent to 1.7 months (4-6 months is balanced)

- The Median Sales Pricerose 5.6 percent to $369,750

- Days on Market rose 18.2 percent to 26 days, on average (median of 15 days, up 50.0 percent)

- Changes in Sales activity varied by market segment

- Single family sales decreased 19.7 percent; Condo sales were down 26.7 percent & townhouse sales fell 17.4 percent

- Traditional sales declined 20.0 percent; foreclosure sales fell 20.8 percent; short sales were up 40.0 percent (from 5 to 7)

- Previously owned sales decreased 20.3 percent; new construction sales declined 11.0 percent

New Listings and Pending Sales

- « Previous Page

- 1

- …

- 17

- 18

- 19

- 20

- 21

- …

- 28

- Next Page »