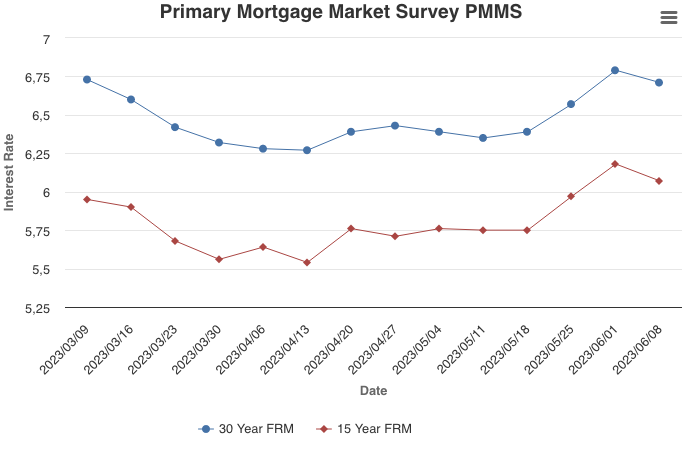

June 8, 2023

Mortgage rates decreased after a three-week climb. While elevated rates and other affordability challenges remain, inventory continues to be the biggest obstacle for prospective homebuyers.

Information provided by Freddie Mac.

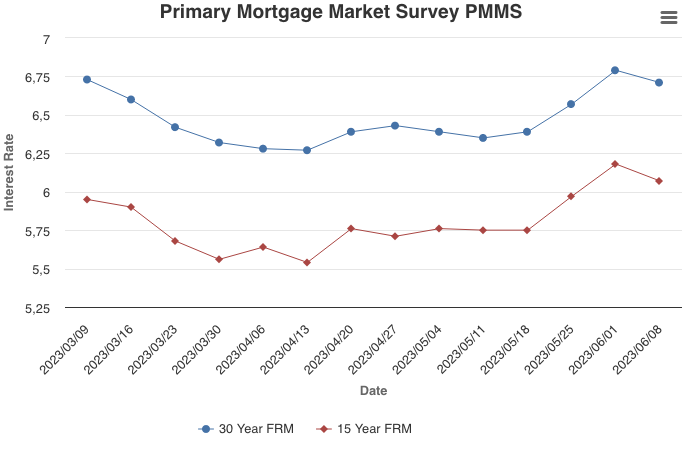

June 8, 2023

Mortgage rates decreased after a three-week climb. While elevated rates and other affordability challenges remain, inventory continues to be the biggest obstacle for prospective homebuyers.

Information provided by Freddie Mac.

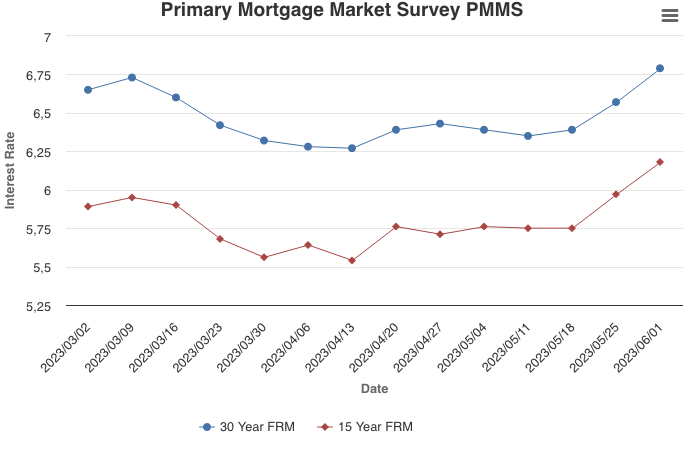

June 1, 2023

Mortgage rates jumped this week, as a buoyant economy has prompted the market to price-in the likelihood of another Federal Reserve rate hike. Although there has been a steady flow of purchase demand around rates in the low to mid six percent range, that demand is likely to weaken as rates approach seven percent.

Information provided by Freddie Mac.

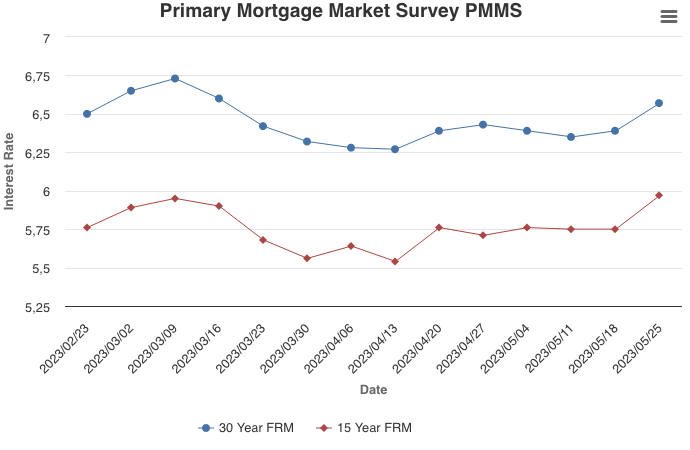

May 25, 2023

The U.S. economy is showing continued resilience which, combined with debt ceiling concerns, led to higher mortgage rates this week. Dampened affordability remains an issue for interested homebuyers and homeowners seem unwilling to lose their low rate and put their home on the market. If this predicament continues to limit supply, it could open up an opportunity for builders to help address the country’s housing shortage.

Information provided by Freddie Mac.

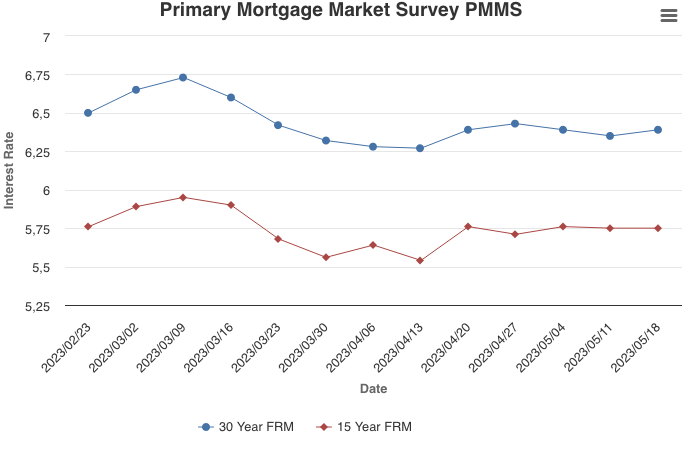

May 18, 2023

The 30-year fixed-rate mortgage averaged 6.39 percent this week, as economic crosscurrents have kept rates within a ten-basis point range over the last several weeks. After the substantial slowdown in growth last fall, home prices stabilized during the winter and began to modestly rise over the last few months. This indicates that while affordability remains a hurdle, homebuyers are getting used to current rates and continue to pursue homeownership.

Information provided by Freddie Mac.

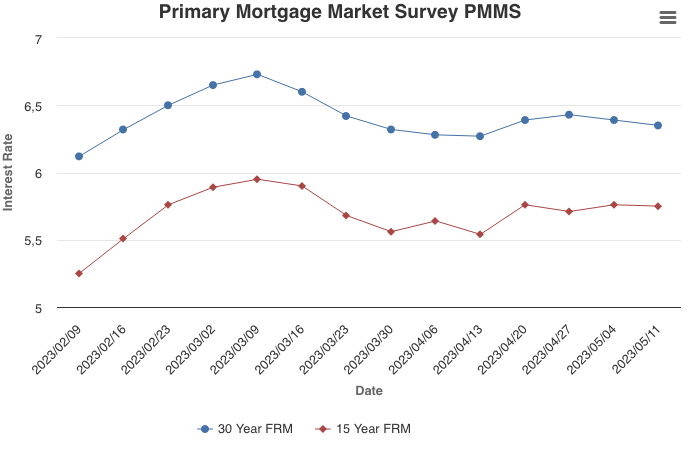

May 11, 2023

May 11, 2023

This week’s decrease continues a recent sideways trend in mortgage rates, which is a welcome departure from the record increases of last year. While inflation remains elevated, its rate of growth has moderated and is expected to decelerate over the remainder of 2023. This should bode well for the trajectory of mortgage rates over the long-term.

Information provided by Freddie Mac.

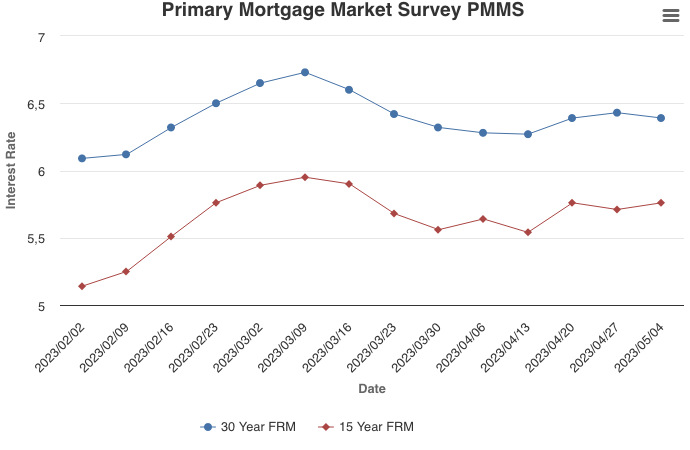

May 4, 2023

This week, mortgage rates inched down slightly amid recent volatility in the banking sector and commentary from the Federal Reserve on its policy outlook. Spring is typically the busiest season for the residential housing market and, despite rates hovering in the mid-six percent range, this year is no different. Interested homebuyers are acclimating to the current rate environment, but the lack of inventory remains a primary obstacle to affordability.

Information provided by Freddie Mac.

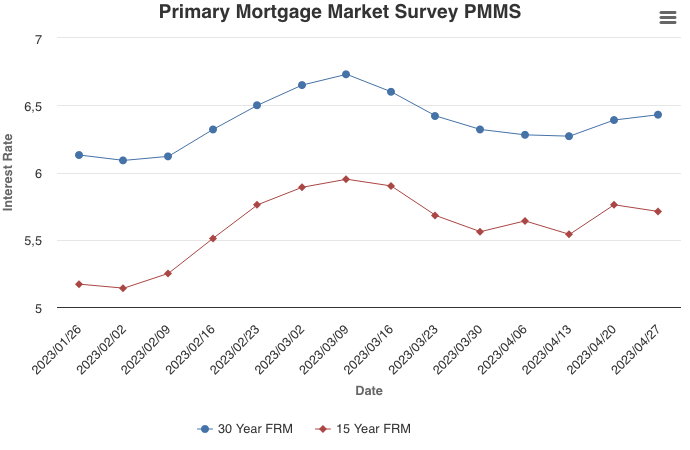

April 27, 2023

The 30-year fixed-rate mortgage increased modestly for the second straight week, but with the rate of inflation decelerating rates should gently decline over the course of 2023. Incoming data suggest the housing market has stabilized from a sales and house price perspective. The prospect of lower mortgage rates for the remainder of the year should be welcome news to borrowers who are looking to purchase a home.

Information provided by Freddie Mac.

April 20, 2023

For the first time in over a month, mortgage rates moved up due to shifting market expectations. Home prices have stabilized somewhat, but with supply tight and rates stuck above six percent, affordable housing continues to be a serious issue for potential homebuyers. Unless rates drop into the mid five percent range, demand will only modestly recover.

Information provided by Freddie Mac.

Licensed In Minnesota

All information deemed reliable but not guaranteed and should be independently verified.