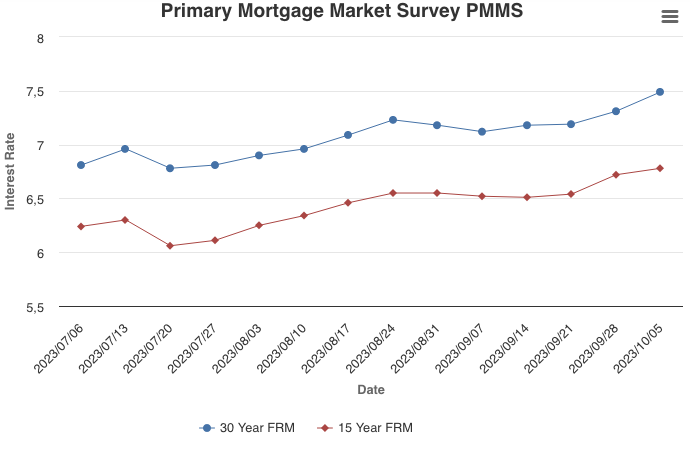

October 5, 2023

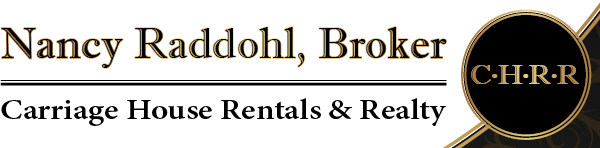

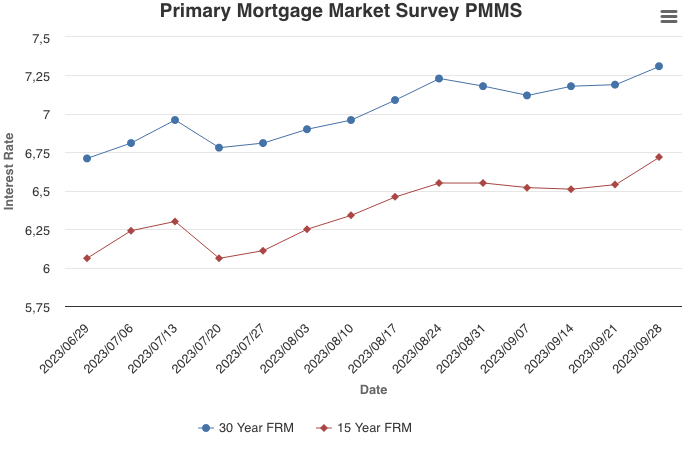

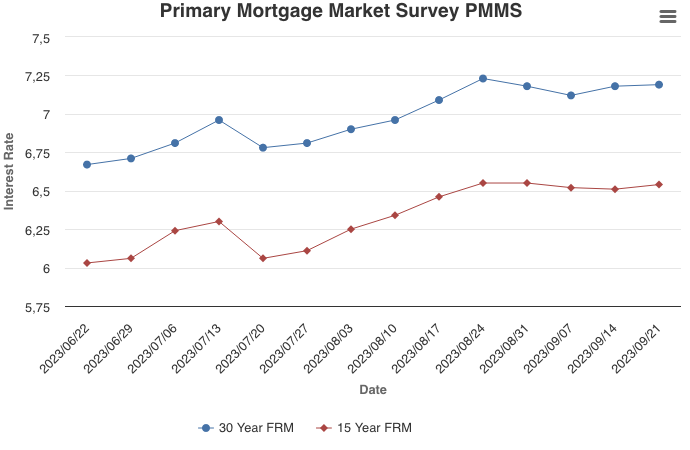

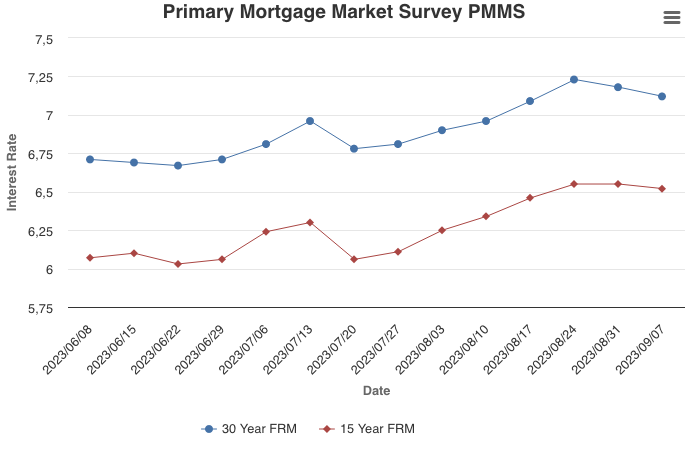

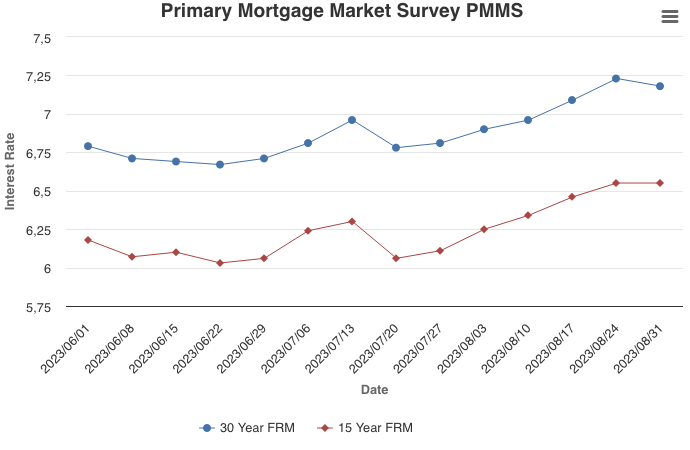

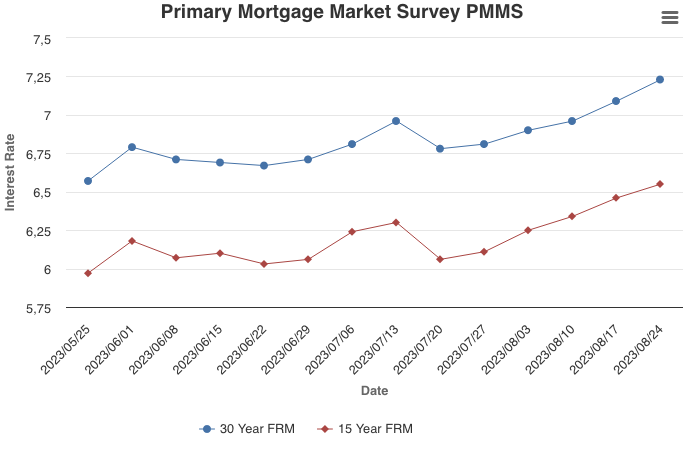

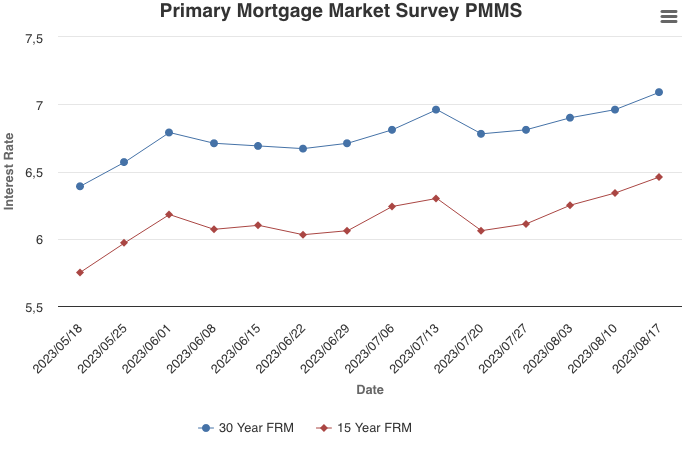

Mortgage rates maintained their upward trajectory as the 10-year Treasury yield, a key benchmark, climbed. Several factors, including shifts in inflation, the job market and uncertainty around the Federal Reserve’s next move, are contributing to the highest mortgage rates in a generation. Unsurprisingly, this is pulling back homebuyer demand.

Information provided by Freddie Mac.