August 7, 2025

The 30-year fixed-rate mortgage dropped to its lowest level since April. The decline in rates increases prospective homebuyers’ purchasing power and Freddie Mac research shows that buyers can save thousands by getting quotes from a few different lenders.

Information provided by Freddie Mac.

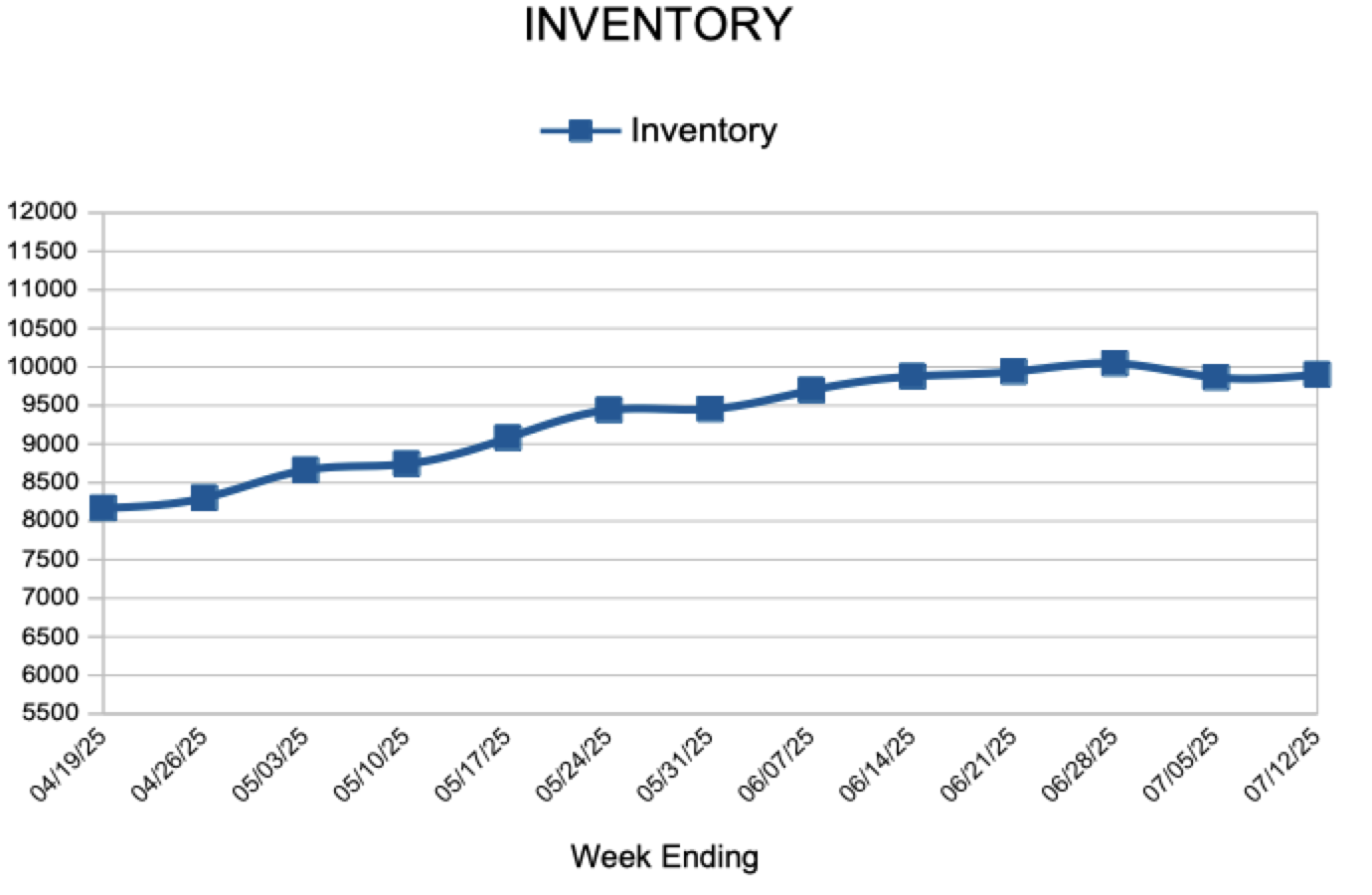

For Week Ending July 26, 2025

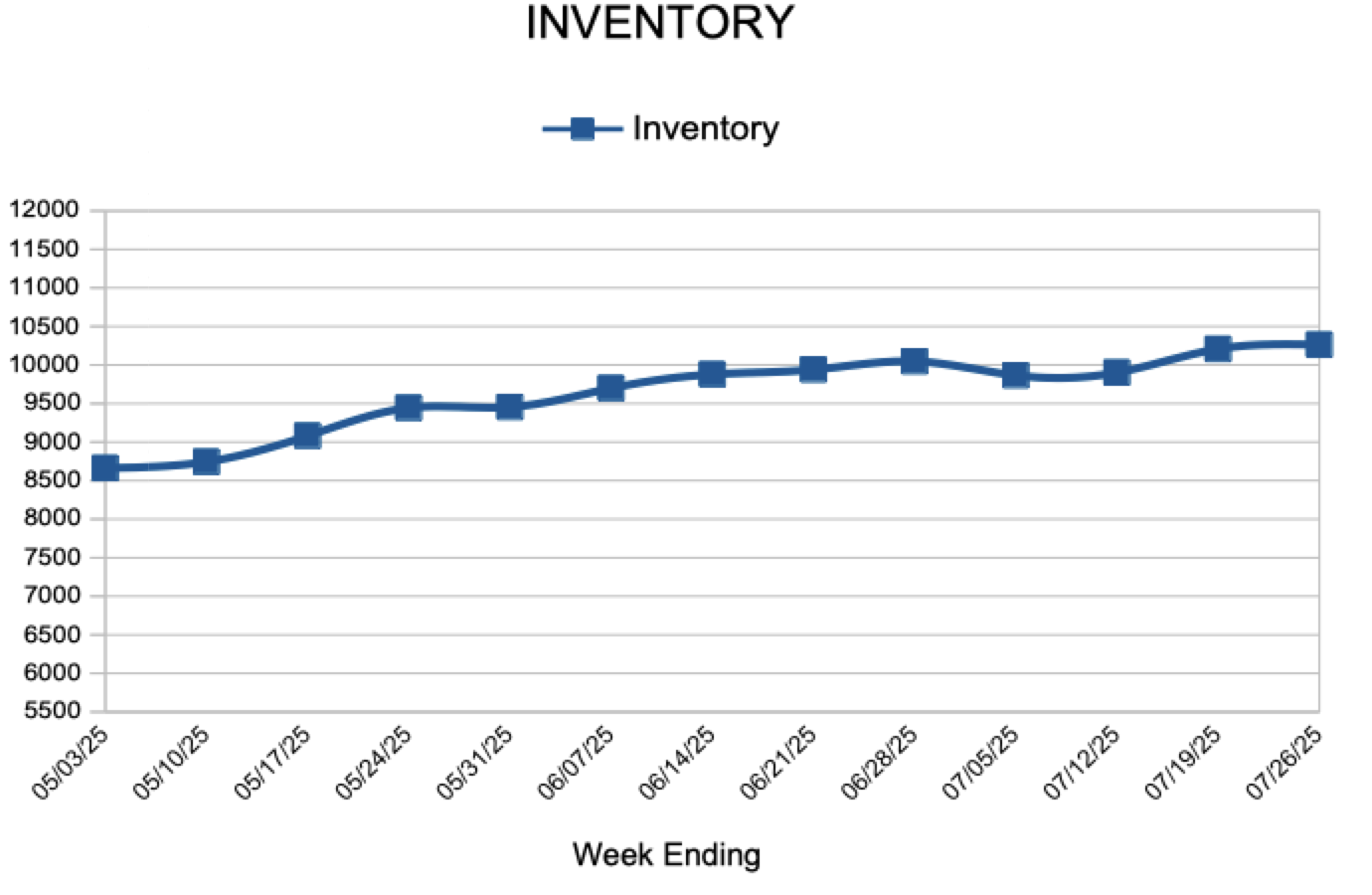

For Week Ending July 26, 2025