Weekly Market Report

For Week Ending June 15, 2024

For Week Ending June 15, 2024

U.S. mortgage performance is in good health overall, according to CoreLogic’s May 2024 Loan Performance Insights report, which found overall delinquency, serious delinquency, and foreclosure rates remained low as of last measure in March 2024. The report notes that just 2.8% of mortgages were delinquent by at least 30 days or more, a 0.2% change from the same period a year before, while serious delinquency and foreclosure inventory rates were 0.9% and 0.3%, respectively.

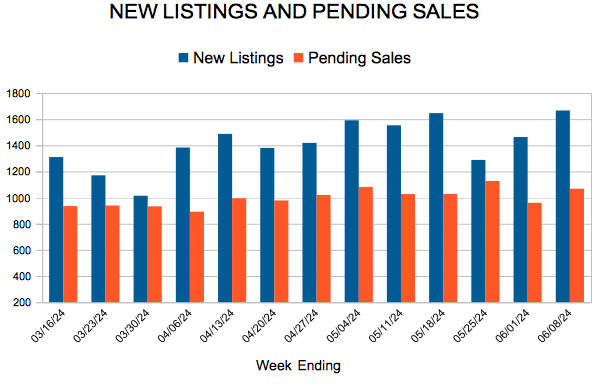

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JUNE 15:

- New Listings decreased 1.6% to 1,564

- Pending Sales decreased 10.8% to 1,033

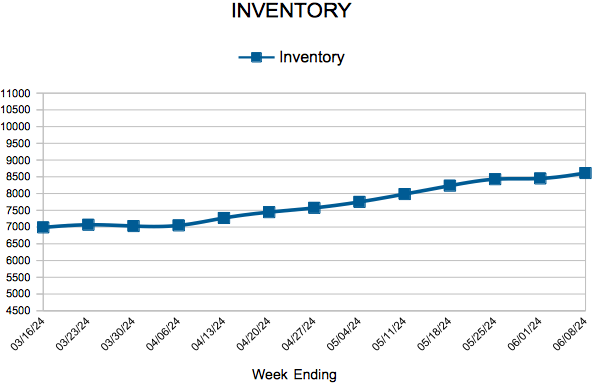

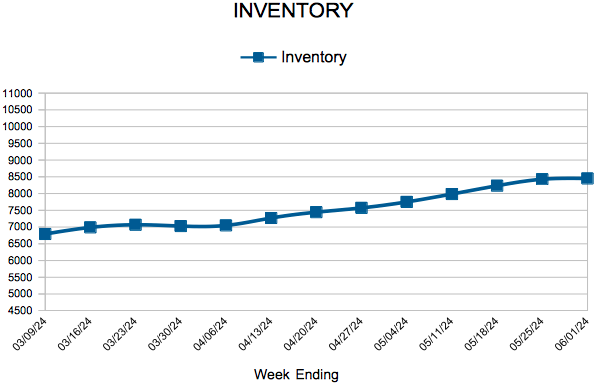

- Inventory increased 12.8% to 8,800

FOR THE MONTH OF MAY:

- Median Sales Price increased 4.1% to $385,000

- Days on Market increased 5.3% to 40

- Percent of Original List Price Received decreased 1.0% to 100.1%

- Months Supply of Homes For Sale increased 21.1% to 2.3

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

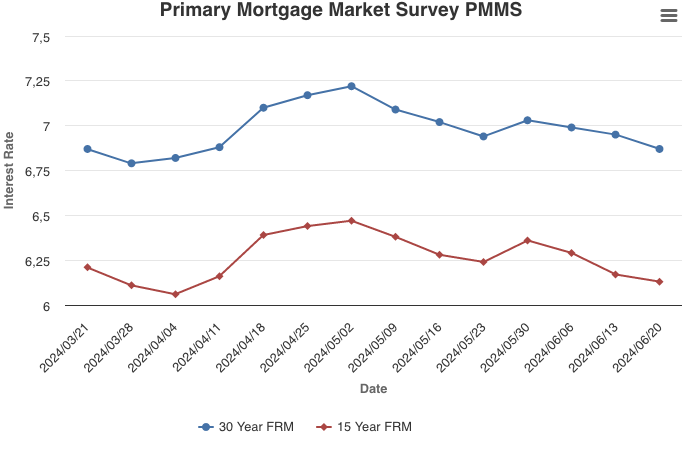

Mortgage Rates Move Lower

June 20, 2024

Mortgage rates fell for the third straight week following signs of cooling inflation and market expectations of a future Fed rate cut. These lower mortgage rates coupled with the gradually improving housing supply bodes well for the housing market. Aspiring homeowners should remember it’s important to shop around for the best mortgage rate as they can vary widely between lenders.

Information provided by Freddie Mac.

May Housing Market Update

Growth in listings met by cooler demand leads to an increase in supply

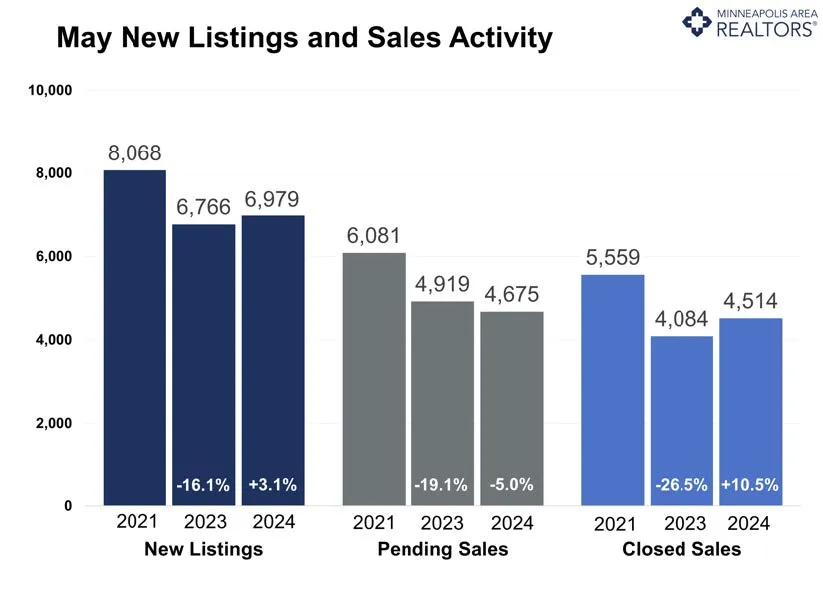

- Signed purchase agreements fell 5.0%; new listings up 3.4%

- The median sales price increased 4.1% to $385,000

- Market times rose 7.2% to 40 days; inventory up 16.3% to 8,653

(Jun. 18, 2024) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, listings rose slightly compared to last year while sales softened. Inventory levels and prices were up.

Sellers, Buyers and Housing Supply

Buyers are starting to notice more inventory across the price spectrum. From under $200,00 to over $1,000,000, there are more homes for sale than there were a year ago. In fact, the number of homes for sale rose 15.7% from last year. That’s the highest number of active listings for May since 2020. And yet every price range—apart from $1,000,000 and above—remains a seller’s market where sellers are still getting strong offers relatively quickly. This year has seen growth in both listings and sales compared to 2023. For May, new listings are up 3.1% while sales fell 5.0%. One factor impacting May sales was higher than expected interest rates. Last May, rates were around 6.4% compared to 7.1% this year. Midyear is a good time to zoom out and look at some year-to-date figures. So far this year, seller activity is up 14.9% while buyer activity is up 5.3%.

A mix of stronger than expected economic data and continued inflation kept mortgage rates higher for longer and led financial markets to price in fewer rate cuts this year. But not everyone is feeling the benefits of the surprisingly resilient economy. Affordability remains a sticking point for would-be buyers—particularly first-time buyers without the equity from the last home to roll into the next. The typical monthly payment on the median-priced home is up over $1,000 since 2020.

There remains plenty of pent-up activity for both buyers and sellers. Even with the recent inventory gains, the market needs about 20,000 active listings to have a balanced market; currently there are fewer than 8,000. Buyers shopping the most affordable price points tend to be more rate-sensitive than luxury buyers who often use cash or have the financial wherewithal to simply absorb the higher payments. Some are able to skip the mortgage entirely by deploying cash. About 17.5% of Twin Cities homes are purchased in cash; it’s nearly double that for properties over $1 million.

Prices, Market Times and Negotiations

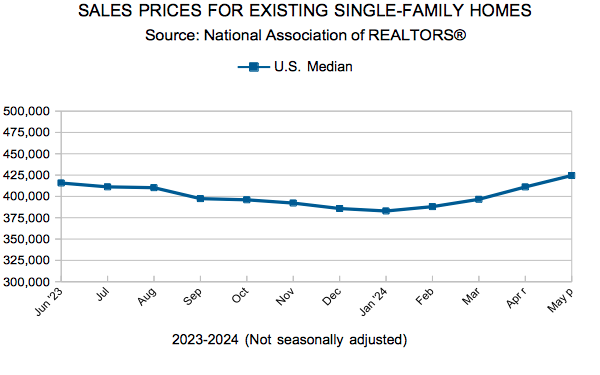

The median home price was up 4.1% to $385,000. Single family prices stood at $420,000, condo prices came in at $220,000 and townhomes checked in at $320,000. New home prices are just over $500,000 while existing home prices are $371,000. Even while they’re still in a relatively strong position, some sellers are finding themselves paying closing costs or incorporating other buyer incentives. “While the market is undergoing corrections, it is not a balanced market yet,” said Amy Peterson, President of the Saint Paul Area Association of REALTORS®. “Buyers need to remain both persistent and strategic ensuring their monthly payments align with their financial plans.”

Quality homes that show well in desirable areas are still getting multiple offers. Market-wide, sellers accepted offers at 100.1% of their list price, which was down from last year. Those purchase agreements were accepted after an average of 40 days on market, which was longer (slower) than last year. Every price point and area are unique. For example, single family homes are selling after 37 days but condos are taking 66 days. “While it’s true that each area and even market segment is unique, there are still some common threads,” said Jamar Hardy, President of Minneapolis Area REALTORS®. “Rising inventory is one of those themes, yet those shopping for homes shouldn’t assume we’re suddenly in a buyer’s market because we’re not.”

Location & Property Type

Since market activity always varies by area, price point and property type, housing markets shouldn’t be considered monolithic. Existing home sales performed better than new home sales. Single family sales fared better than condos or townhomes. Sales over $500,000 rose while sales under $500,000 softened. Cities such as Cambridge, New Richmond, Hugo and Buffalo saw among the largest sales gains while Arden Hills, Princeton, Medina and North Branch all had weaker demand. For cities with at least five sales, the highest priced areas were Wayzata, North Oaks, Excelsior and Mendota Heights. The most affordable areas were Norwood Young America, Albertville, Vadnais Heights and South St. Paul.

May 2024 Housing Takeaways (compared to a year ago)

- Sellers listed 6,979 properties on the market, a 3.1% increase from last May

- Buyers signed 4,675 purchase agreements, up 5.0% (4,514 closed sales, up 10.5%)

- Inventory levels increased 15.7% to 8,614 units

- Month’s Supply of Inventory rose 21.1% to 2.3 months (4-6 months is balanced)

- The Median Sales Price was up 4.1% to $385,000

- Days on Market was down 5.3% to 40 days, on average (median of 15 days, up 15.4%)

- Changes in Pending Sales activity varied by market segment and price point

- Single family sales fell 2.3%; condo sales were down 15.4%; townhouse sales decreased 10.2%

- Traditional sales were down 4.6%; foreclosure sales declined 12.5% to 42; short sales rose 25.0% to 10

- Previously owned sales decreased 3.8%; new construction sales were down 9.5%

- Sales under $500,000 declined 8.6%; sales over $500,000 increased 8.7%

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending June 8, 2024

For Week Ending June 8, 2024

U.S. home prices have increased by more than 47% since 2020, according to a recent analysis by ResiClub of the Case-Shiller National Home Price Index, outpacing the growth of the 1990s and 2010s, which saw prices rise 30.1% and 44.7%, respectively. Analysts say home price growth this decade is on track to surpass the growth of the 2000s, when home prices rose 47.3%.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JUNE 8:

- New Listings increased 3.2% to 1,666

- Pending Sales decreased 7.1% to 1,068

- Inventory increased 12.9% to 8,613

FOR THE MONTH OF MAY:

- Median Sales Price increased 4.1% to $385,000

- Days on Market increased 5.3% to 40

- Percent of Original List Price Received decreased 1.0% to 100.1%

- Months Supply of Homes For Sale increased 21.1% to 2.3

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

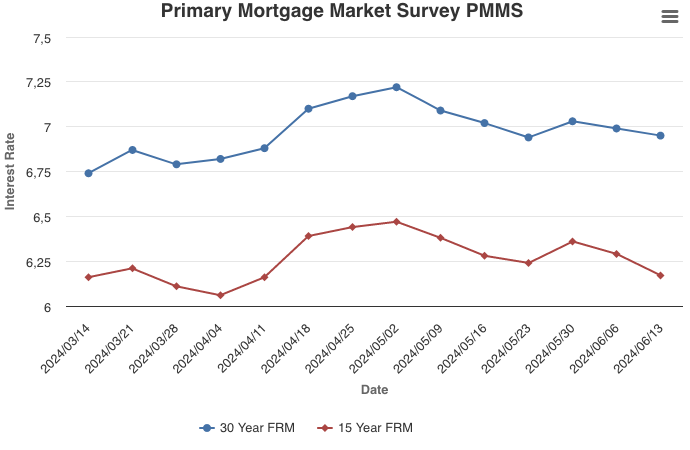

Mortgage Rates Continue to Move Down

June 13, 2024

Mortgage rates continued to fall back this week as incoming data suggests the economy is cooling to a more sustainable level of growth. Top-line inflation numbers were flat but shelter inflation, which measures rent and homeownership costs, increased showing that housing affordability continues to be an ongoing impediment for buyers on the house hunt.

Information provided by Freddie Mac.

Inventory

New Listings and Pending Sales

- « Previous Page

- 1

- …

- 30

- 31

- 32

- 33

- 34

- …

- 104

- Next Page »