Weekly Market Report

For Week Ending November 15, 2025

For Week Ending November 15, 2025

The U.S. housing supply gap reached 3.8 million units in 2024, according to an analysis by Realtor®.com. For the first time since 2016, new construction outpaced household formations, with more than 1.6 million units completed last year, the highest level in nearly two decades. While builders are making progress, it would still take about 7.5 years to close the housing gap at the 2024 pace of construction.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 15:

- New Listings increased 0.7% to 1,022

- Pending Sales decreased 1.8% to 774

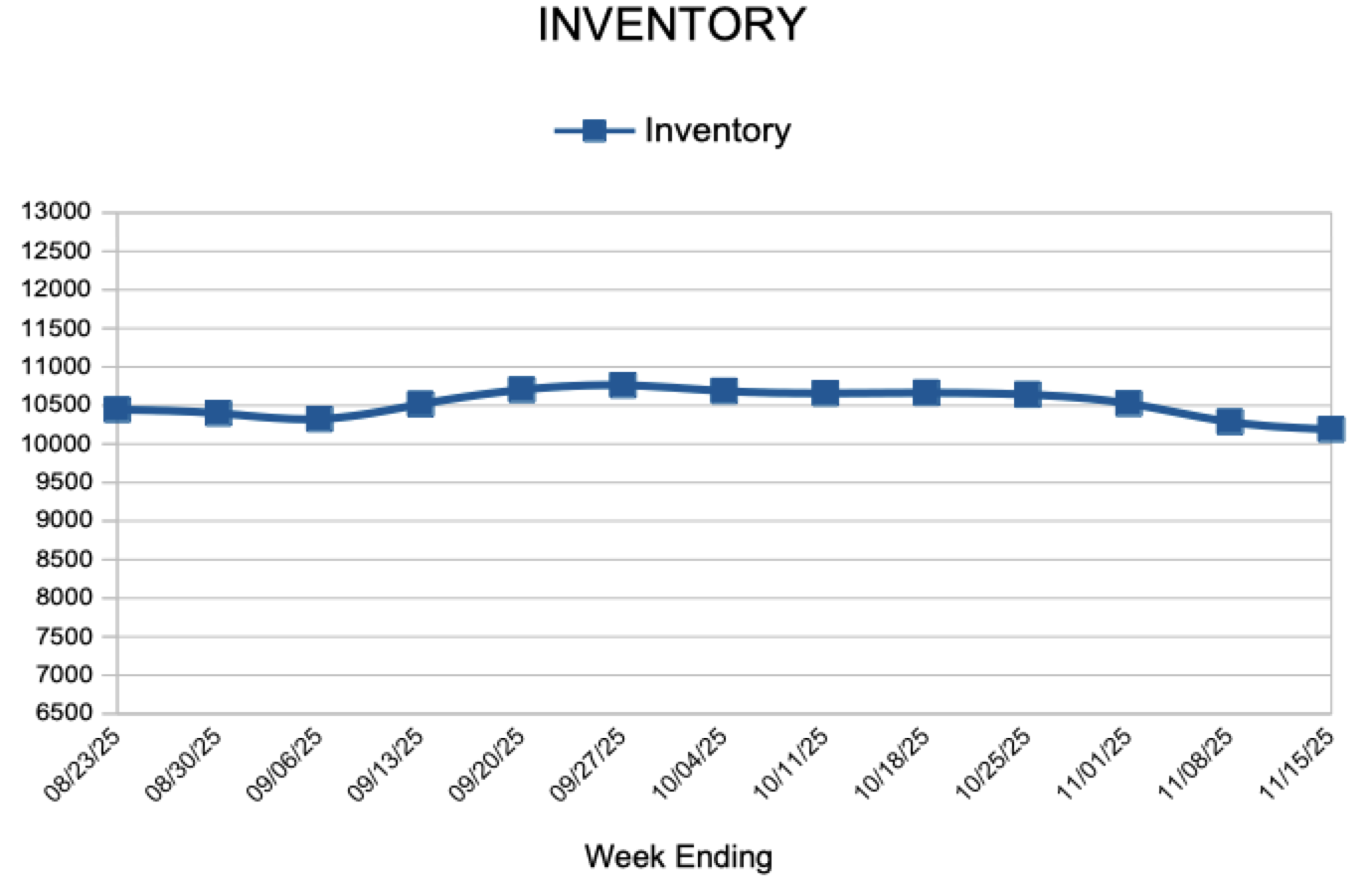

- Inventory increased 0.8% to 10,190

FOR THE MONTH OF OCTOBER:

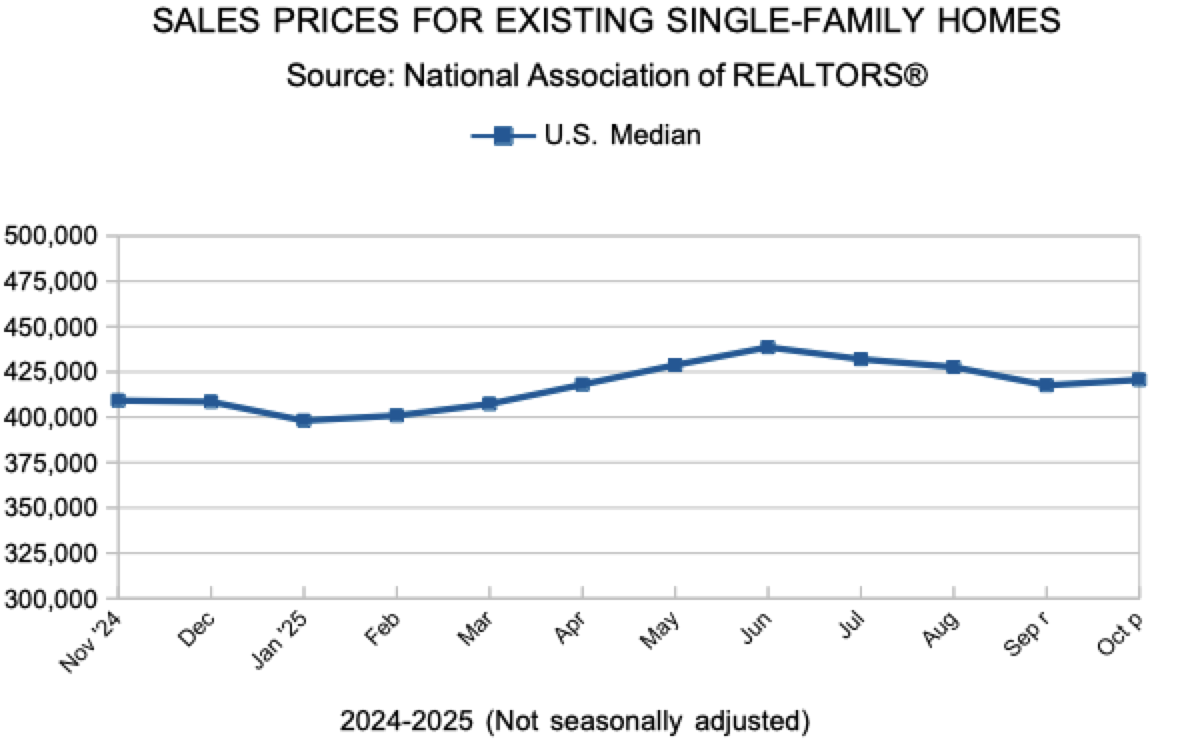

- Median Sales Price increased 2.1% to $389,900

- Days on Market increased 6.7% to 48

- Percent of Original List Price Received increased 0.3% to 98.1%

- Months Supply of Homes For Sale decreased 3.6% to 2.7

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

October Monthly Skinny Video

Mortgage Rates Show Little Movement

November 20, 2025

Mortgage rates have been shifting within a narrow ten-basis point range over the last month. This rate stability is a positive sign for both buyers and sellers, as it helps provide greater certainty in the housing markets.

Information provided by Freddie Mac.

Existing Home Sales

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending November 8, 2025

For Week Ending November 8, 2025

According to ResiClub’s analysis of the U.S. Census Bureau’s 2024 American Community Survey, 35 million, or 40.3%, of U.S. homeowners are mortgage-free, up from 39.8% in 2023. More than half of these homeowners (54%) are aged 65 or older, a group that represents just over a third (34.1%) of all U.S. homeowners, with 64% owning their homes outright.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING NOVEMBER 8:

- New Listings increased 9.8% to 1,127

- Pending Sales increased 5.4% to 780

- Inventory increased 0.2% to 10,287

FOR THE MONTH OF OCTOBER:

- Median Sales Price increased 2.1% to $389,900

- Days on Market increased 6.7% to 48

- Percent of Original List Price Received increased 0.3% to 98.1%

- Months Supply of Homes For Sale decreased 3.6% to 2.7

All comparisons are to 2024

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Broadly Flat

November 13, 2025

Rates for the 30-year and the 15-year fixed-rate mortgage essentially remained flat this week, but purchase activity increased, which is encouraging.

Information provided by Freddie Mac.