October 31, 2024

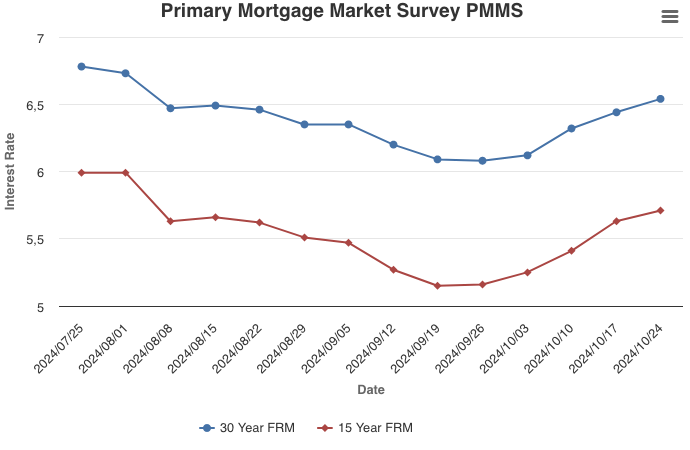

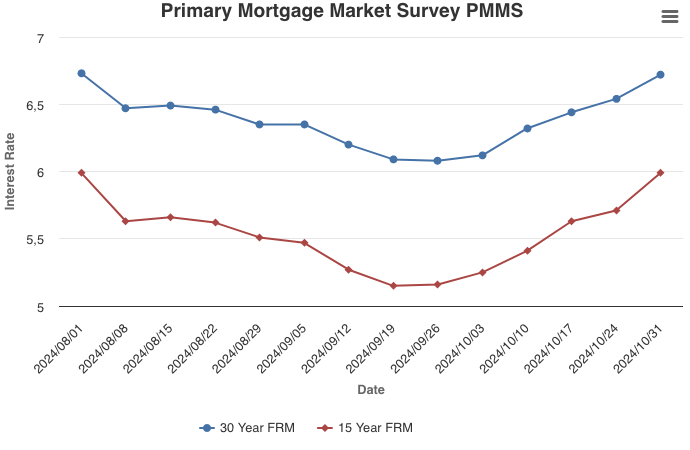

Increasing for the fifth consecutive week, mortgage rates reached their highest level since the beginning of August. With several potential inflection points happening over the next week, including the jobs report, the 2024 election, and the Federal Reserve interest rate decision, we can expect mortgage rates to remain volatile. Although uncertainty will remain, it does appear mortgage rates are cresting, and are not expected to reach the highs seen earlier this year.

Information provided by Freddie Mac.

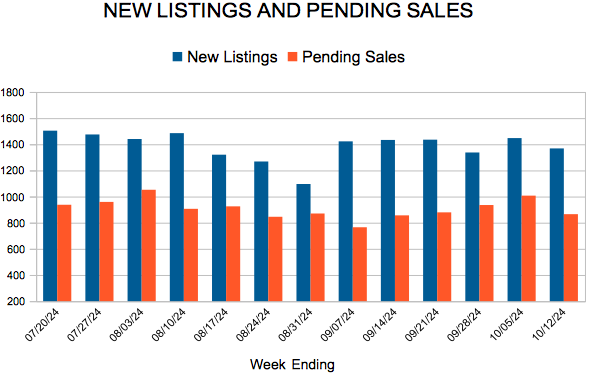

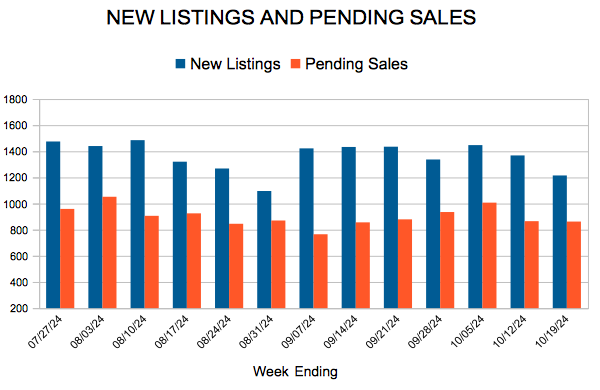

For Week Ending October 19, 2024

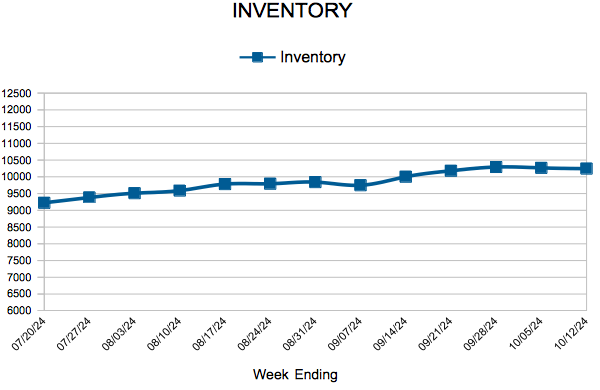

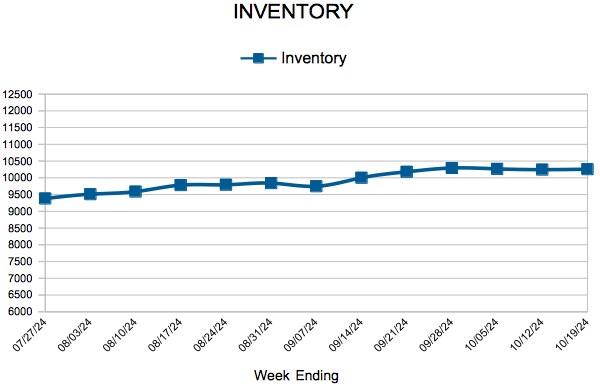

For Week Ending October 19, 2024