November 16, 2023

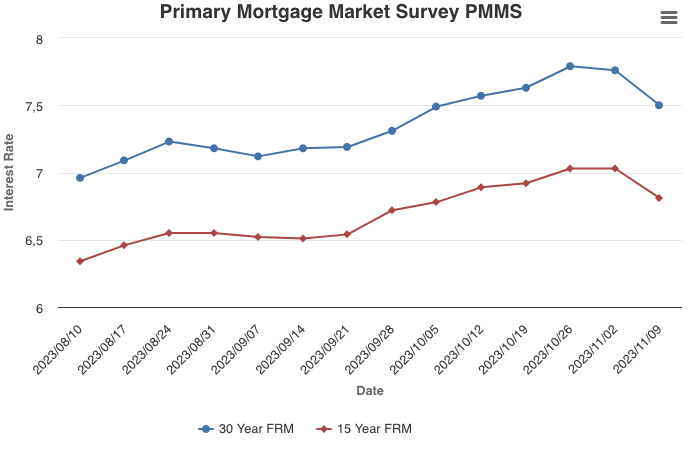

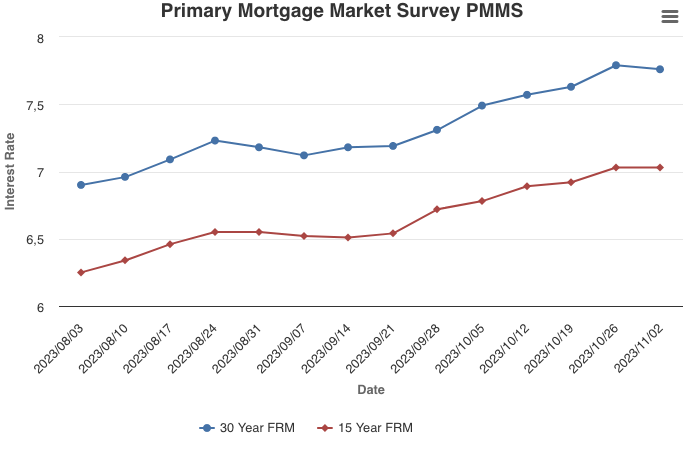

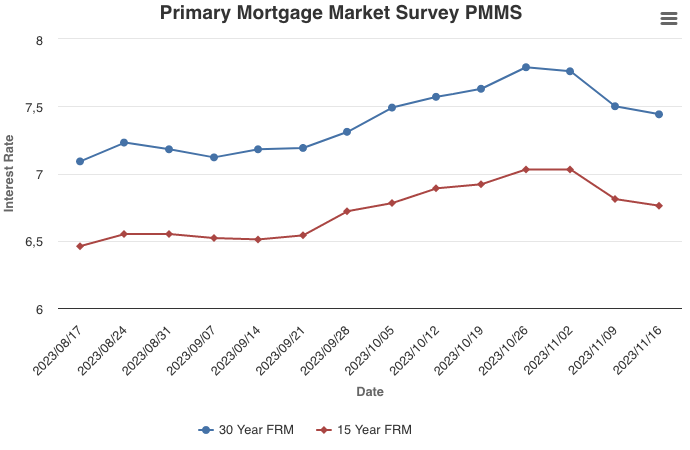

For the third straight week, mortgage rates trended down, as new data indicates that inflationary pressures are receding. The combination of continued economic strength, lower inflation and lower mortgage rates should likely bring more potential homebuyers into the market.

Information provided by Freddie Mac.

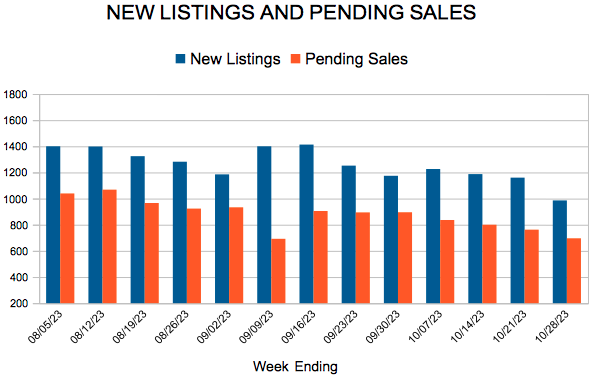

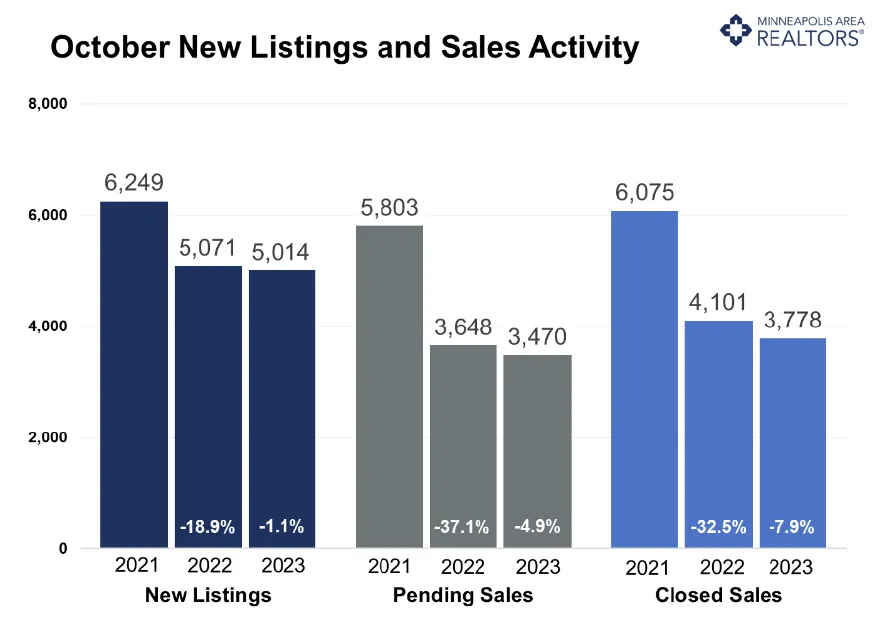

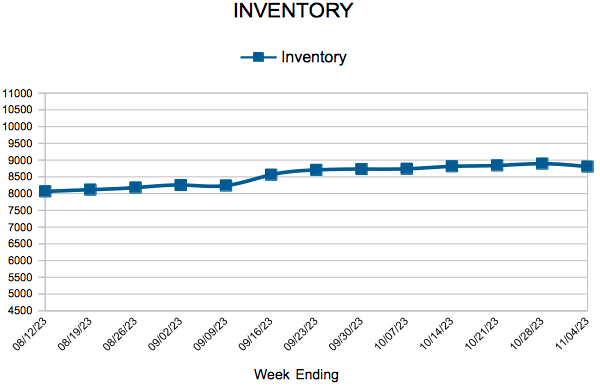

For Week Ending November 4, 2023

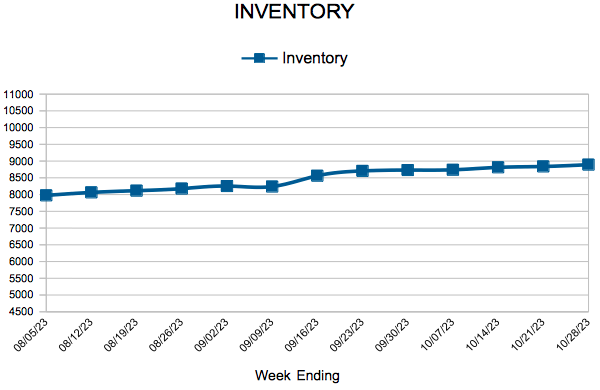

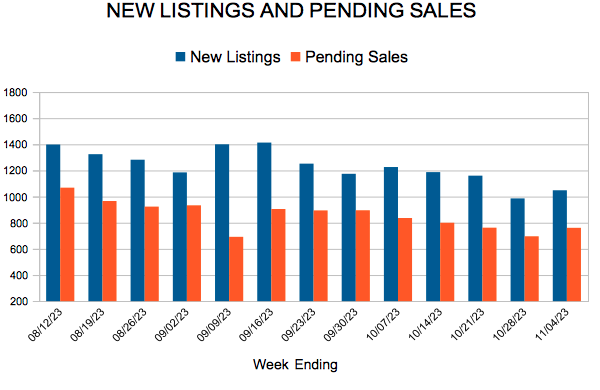

For Week Ending November 4, 2023