For Week Ending May 21, 2022

For Week Ending May 21, 2022

Rental prices continue to soar to new highs, with the median rent reaching $1,827 as of last measure, a 16.7% increase from the same time last year, according to Realtor.com. Rental units are in short supply and demand remains high, with real estate professionals reporting a surge in rental inquiries, applications, and showing activity across the nation. Bidding wars are becoming increasingly common in many rental home markets, causing some properties to rent for substantially over asking price.

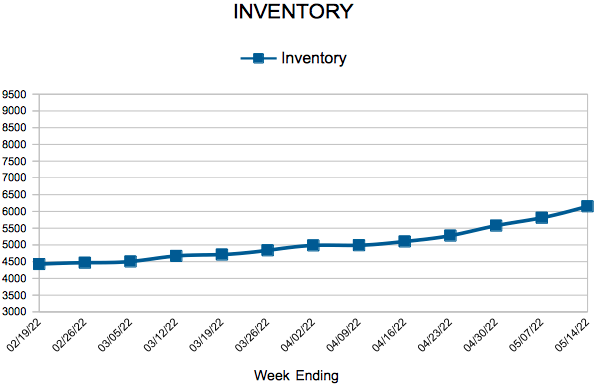

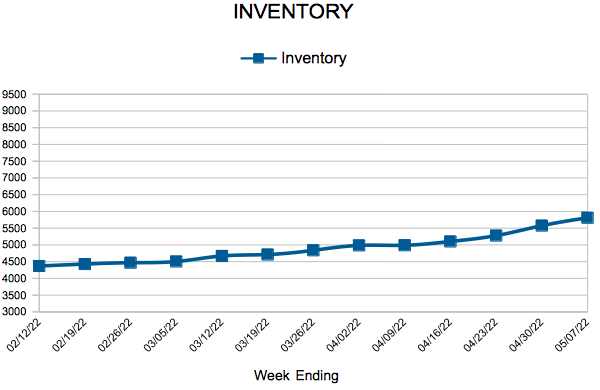

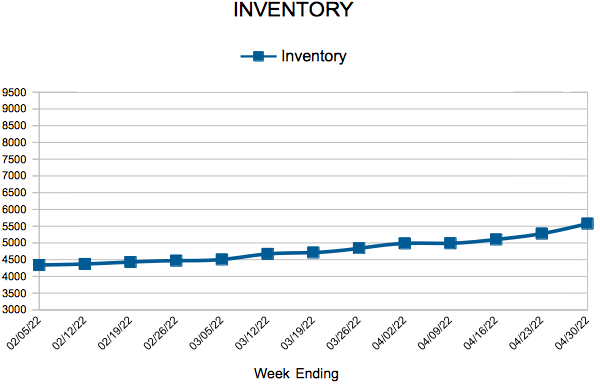

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MAY 21:

- New Listings increased 3.4% to 2,008

- Pending Sales decreased 8.7% to 1,490

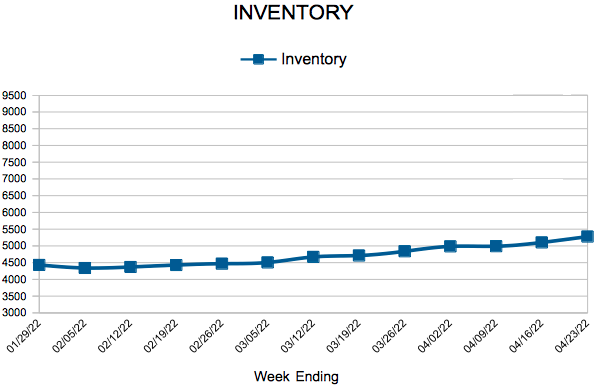

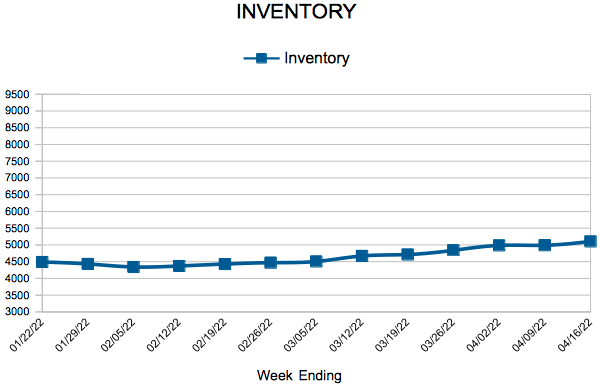

- Inventory increased 2.9% to 6,626

FOR THE MONTH OF APRIL:

- Median Sales Price increased 10.0% to $370,000

- Days on Market decreased 9.7% to 28

- Percent of Original List Price Received increased 0.5% to 103.8%

- Months Supply of Homes For Sale remained flat at 1.1

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.