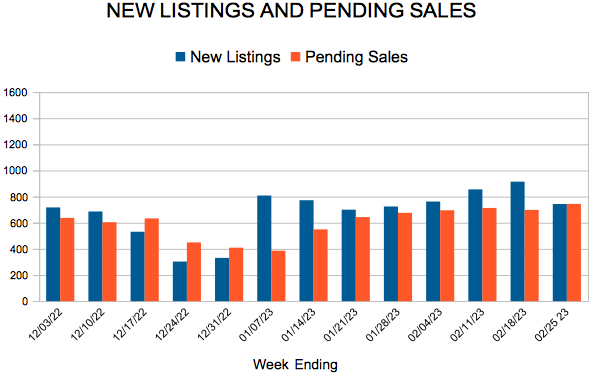

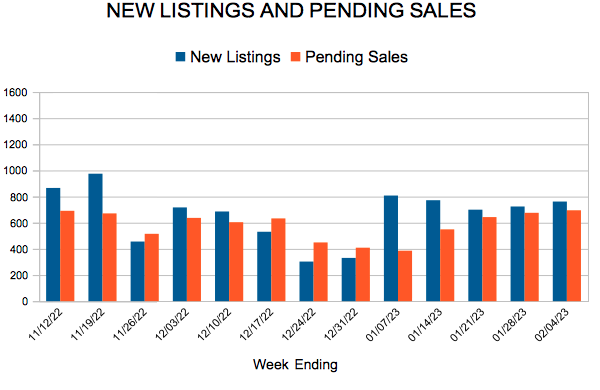

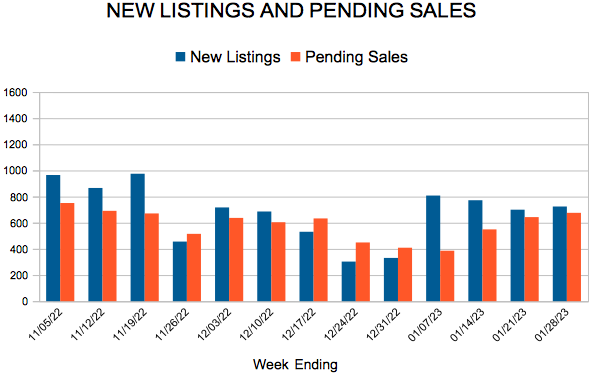

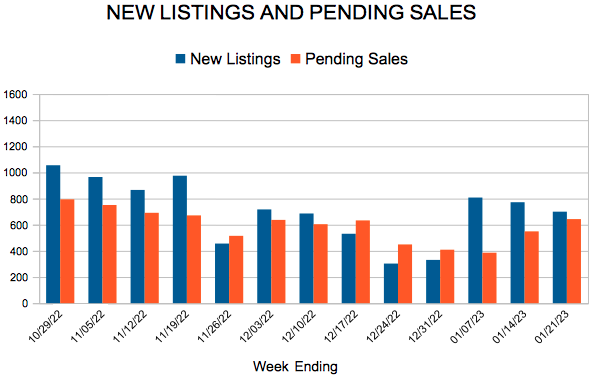

New Listings and Pending Sales

Twin Cities Price Growth Stabilizes to Match Historic Norms

- Median sales price of Twin Cities homes rose 2.7 percent to just under $342,000

- Buyer activity down 19.3 percent with 2,560 pending sales

- Sellers listed 10.6 percent fewer homes compared to last January

(February 15, 2022) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, the median sales price across the Twin Cities grew 2.7 percent to $341,995. The metro is returning to historic trends for median home price growth.

Inventory & Home Prices

The Twin Cities’ median home price grew 2.7 percent despite 19.3 percent fewer signed contracts. After about three straight years of roughly 10.0 percent year-over-year price growth, this modest increase is more aligned with the historical average of 3.2 percent across the region. While price growth is slowing, it remained positive throughout 2022 and this year is expected to continue that trend of moderating growth, barring any unforeseen circumstances.

“Anyone concerned about runaway home prices should be comforted by the more typical price growth we’re seeing, which gives buyers a chance to catch their breath and incomes a chance to catch up,” said Brianne Lawrence, President of the Saint Paul Area Association of REALTORS®. “While the Twin Cities remains a seller’s market, homes are taking longer to sell and sellers are accepting less than their list price.”

Softening buyer activity led to 14.5 percent more homes on the market at month-end, closing out January with 5,588 units in inventory. Yet we remain undersupplied—especially if interest rates moderate in response to inflation subsiding and demand once again soars. The metro only has 1.3 month’s supply of inventory. Typically 4-6 months of supply are needed to reach a balanced market.

Sales & Listings

As the market reacts to a series of aggressive rate hikes by the Federal Reserve in an effort to slow borrowing and cool an overheated economy, home buyer activity has also cooled. Facing higher mortgage rates and monthly payments than they would have in 2022, buyers signed 2,560 purchase agreements, 19.3 percent fewer than last year. Meanwhile 2,083 homes closed, down 32.2 percent from last year and the lowest figure since 2010. But that reflects contracts signed 30 to 60 days earlier.

“Sellers need to be priced right and may not see a dozen plus offers immediately, but most sellers are getting deals done with terms they’re comfortable with, and still more quickly than in the past,” according to Jerry Moscowitz, President of Minneapolis Area REALTORS®. “The truth is, what feels like a slow-down from light speed is actually close to how the market used to and probably should feel. You know, there’s actually a chance that listing you’ve been eyeing will be there later tonight or even tomorrow!”

There were 3,285 homes listed in January, 10.6 percent fewer listings than January 2022. Last month, half of all sellers sold homes for at or below 97.3 percent of their list price compared to 100.0 percent last year. Additionally, they accepted those offers after an average of 60 days on market compared to 41. Today’s sellers should be patient, flexible and ensure their expectations are in-line with market realities.

Location & Property Type

Market activity varies by area, price point and property type. New home sales fell 30.8 percent while existing home sales were down 31.3 percent. Single family sales fell 33.3 percent, condo sales declined 5.7 percent and townhome sales were down 32.3 percent. Sales in Minneapolis decreased 25.8 percent while Saint Paul sales fell 40.2 percent. Cities like St. Michael, Andover, and Minnetonka saw the largest sales gains while Savage, Eagan, and Brooklyn Park all had notably lower demand than last year.

January 2022 Housing Takeaways (compared to a year ago)

- Sellers listed 3,285 properties on the market, a 10.6 percent decrease from last January

- Buyers signed 2,560 purchase agreements, down 19.3 percent (2,083 closed sales, down 32.2 percent)

- Inventory levels grew 14.5 percent to 5,588 units

- Month’s Supply of Inventory rose 44.4 percent to 1.3 months (4-6 months is balanced)

- The Median Sales Price rose 2.7 percent to $341,995

- Days on Market rose 46.3 percent to 60 days, on average (median of 43 days, up 95.5 percent)

- Changes in Sales activity varied by market segment

- Single family sales decreased 33.4 percent; Condo sales were down 5.7 percent & townhouse sales fell 32.7 percent

- Traditional sales declined 31.7 percent; foreclosure sales fell 22.6 percent; short sales fell 25.0 percent

- Previously owned sales decreased 31.3 percent; new construction sales declined 30.8 percent

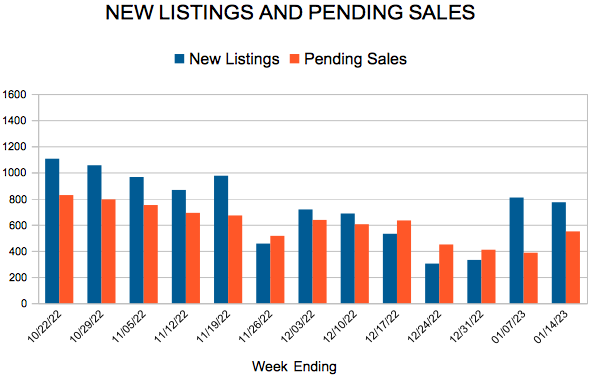

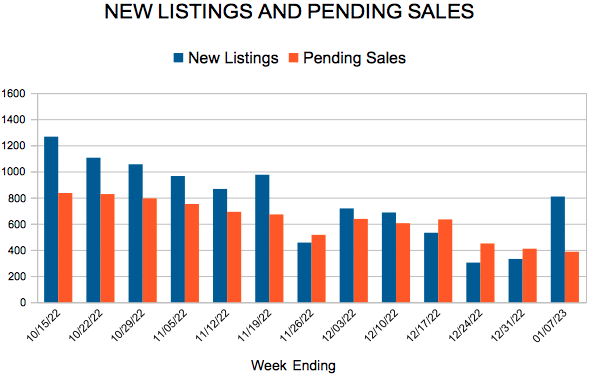

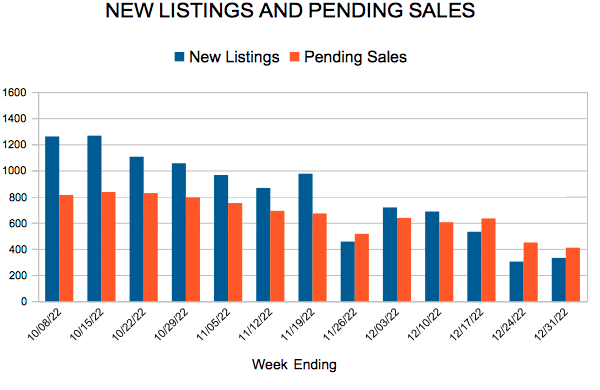

New Listings and Pending Sales

New Listings and Pending Sales

New Listings and Pending Sales

New Listings and Pending Sales

Rising rates pushed sales down for every month in 2022 compared to 2021

Higher mortgage rates and rising prices increased monthly housing costs for buyers

Minneapolis–Saint Paul, Minnesota (January 18, 2023) – The first and second half of 2022 couldn’t have looked more different, according to an annual report issued by Minneapolis Area REALTORS® and the St. Paul Area Association of REALTORS®®. After sales reached a 20-year high in 2021 while the number of homes for sale hit a 20-year low, sales in 2022 retreated to their lowest level since 2014 while housing inventory started to rise. That dynamic reflects higher mortgage rates—more than doubling from 3.25 percent to over 7.0 percent—seen in the back half of the year, and it’s rippled throughout virtually every other housing indicator. For sellers, the year still brought record sales prices despite slower increases as the year went on. But multiple offers over asking price in the first half gave way to rising market times and weaker offers in the second half.

“It felt like the housing frenzy was continuing into spring and summer, but the Fed [Federal Reserve] poured cold water on that in a hurry as inflation rose dramatically,” said Brianne Lawrence, President of the Saint Paul Area Association of REALTORS®. “In some ways that was a necessary evil, as that price and sales growth wasn’t sustainable long term. Real estate can be boom and bust like that. But over time, we’ll get back on track like we always do.”

Because 2020 and 2021 were such unique years, it’s worth comparing 2022 to a pre-COVID year. When compared to 2019, home sales in 2022 were down 10.3 percent. While market times are up compared to 2021, homes are still selling more quickly than in 2019 and 2020. One area where the cool-down is notable is in the strength of offers that sellers accept on a monthly basis. Although sellers received on average 100.9 percent of their list price for the year, they accepted 96.3 percent in December. That’s the lowest figure since December 2016.

“I went from sifting through more than 10 offers with my sellers to counseling them about being patient while on the market all within one year’s time,” said Jerry Moscowitz, President of Minneapolis Area REALTORS®. “Inflation may be turning a corner and rates could moderate by summer. If that happens, pent-up demand will surface and we’ll go right back to a competitive market with bidding wars where demand far exceeds supply.”

The ongoing supply-demand imbalance combined with rising rates and rising prices has truly exacerbated affordability concerns pricing too many out of the marketplace. The Housing Affordability Index reached its lowest level since at least 2004. But the Twin Cities is still better than most comparable metros. Currently, the regional median income is 95.0 percent of the necessary income needed to qualify for the median-priced home at today’s interest rates while avoiding becoming cost-burdened, which is typically defined as spending 30.0 percent or less of one’s pre-tax income on housing costs.

Overall, since both buyer and seller activity came down in tandem, the balance of market activity has remained relatively tight. Rising supply combined with falling demand can sometimes result in prices softening. But at $362,500, the median home price is still rising, albeit at a slower pace. New homes tended to outperform along with the over $1M luxury segment which even saw an increase in sales compared to last year. Although condo sales declined with the rest of the market, market times were flat while sellers accepted stronger offers.

While it was a year of fluctuations, tens of thousands of Minnesotans were able to get their housing goals met. As inflation cools the rate environment could ease. That could incentivize more demand that would still be faced with a shortage of supply. Housing supply is structural; housing demand is cyclical.

For other year-end residential real estate information and for stand-alone December 2022 data, please visit www.mplsrealtor.com and www.spaar.com.

2022 BY THE NUMBERS | COMPARED TO 2021

- Sellers listed 68,006 properties on the market, a 10.0 percent decrease from 2021

- Buyers closed on 53,714 properties, down 19.1 percent

- The Median Sales Price rose 6.6 percent to $362,500

- Inventory levels rose 16.2 percent to 5,914 units as of year-end

- Months Supply of Inventory was up 47.1 percent to 1.4 months of supply (5-6 months is balanced)

- Days on Market increased 10.7 percent to 31 days, on average (median of 14, up 27.3 percent)

- Changes in Sales activity varied by market segment

- Single family sales were down 19.2 percent; condo sales fell 20.3 percent; townhome sales decreased 17.8 percent

- Traditional sales fell 19.2 percent; foreclosure sales rose 1.5 percent; short sales were up 6.7 percent

- Previously owned sales decreased 20.1 percent; new construction sales fell 8.3 percent

- $1M+ luxury sales grew 7.5 percent to a record high

New Listings and Pending Sales

New Listings and Pending Sales

- « Previous Page

- 1

- …

- 15

- 16

- 17

- 18

- 19

- …

- 28

- Next Page »