Inventory

Weekly Market Report

For Week Ending June 18, 2022

For Week Ending June 18, 2022

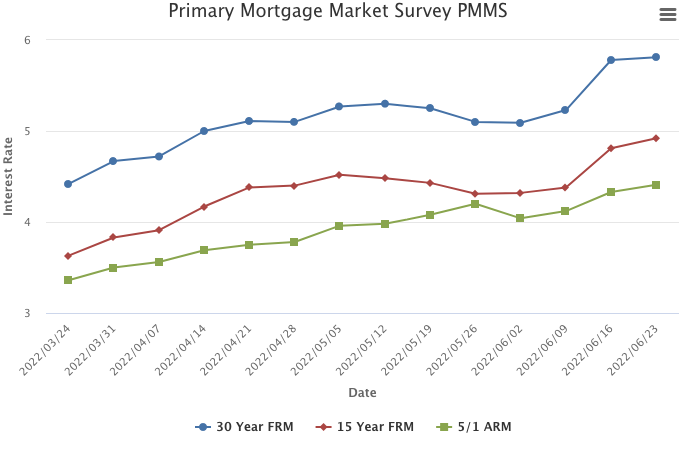

The 30-year fixed rate mortgage averaged 5.78% the week ending 6/17, rising 55 basis points from the previous week and marking the largest one week increase since 1987, according to Freddie Mac. Mortgage rates are nearly double compared to this time last year, with rates spiking following the Federal Reserve’s recent decision to raise the benchmark interest rate by three quarters of a percentage point in order to help quash rising inflation.

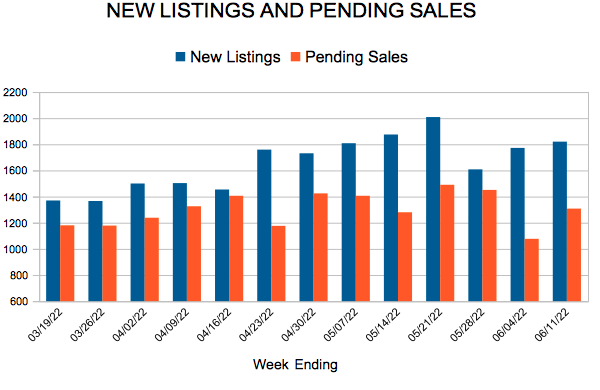

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JUNE 18:

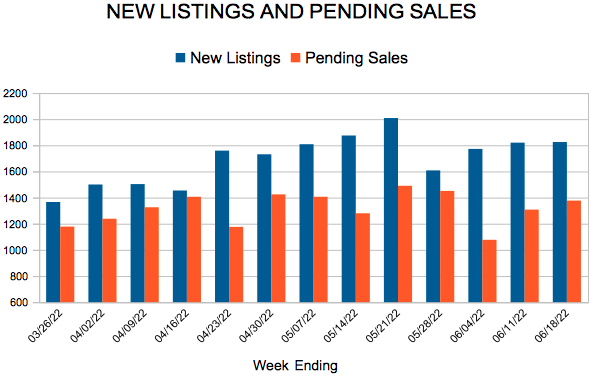

- New Listings decreased 14.6% to 1,825

- Pending Sales decreased 11.6% to 1,377

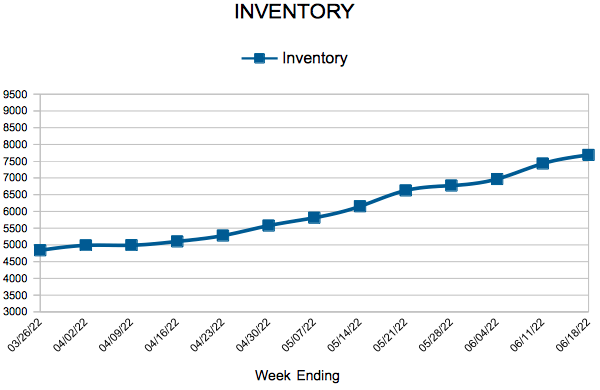

- Inventory increased 7.8% to 7,687

FOR THE MONTH OF MAY:

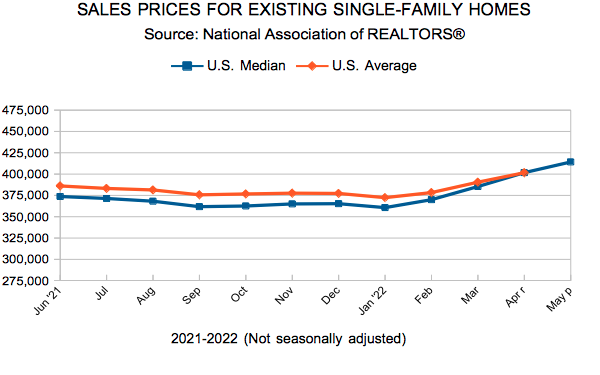

- Median Sales Price increased 9.0% to $375,000

- Days on Market decreased 4.2% to 23

- Percent of Original List Price Received increased 0.1% to 104.1%

- Months Supply of Homes For Sale increased 27.3% to 1.4

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Continue to Move Up

June 23, 2022

Fixed mortgage rates have increased by more than two full percentage points since the beginning of the year. The combination of rising rates and high home prices is the likely driver of recent declines in existing home sales. However, in reality many potential homebuyers are still interested in purchasing a home, keeping the market competitive but leveling off the last two years of red-hot activity.

Information provided by Freddie Mac.

May Monthly Skinny Video

Existing Home Sales

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending June 11, 2022

For Week Ending June 11, 2022

To help fight rising inflation, which hit 8.6% as of last measure, the Federal Reserve raised interest rates by three quarters of a percentage point, the largest interest rate hike in 28 years. The U.S. central bank will boost its short-term policy rate to 1.50% – 1.75%, increasing consumer borrowing costs on everything from credit cards to car loans. This marks the third rate increase this year, with the Fed planning additional rate increases throughout the year.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JUNE 11:

- New Listings decreased 7.7% to 1,820

- Pending Sales decreased 14.6% to 1,308

- Inventory increased 11.7% to 7,429

FOR THE MONTH OF MAY:

- Median Sales Price increased 9.0% to $375,000

- Days on Market decreased 4.2% to 23

- Percent of Original List Price Received increased 0.1% to 104.1%

- Months Supply of Homes For Sale increased 27.3% to 1.4

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

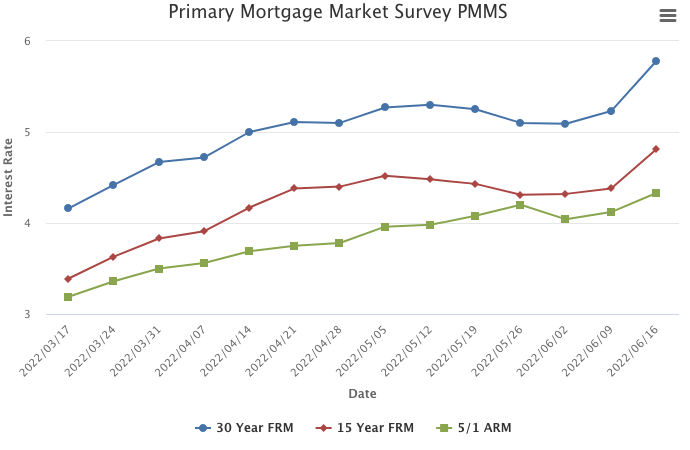

Mortgage Rates Surge on Inflation Expectations

June 16, 2022

Mortgage rates surged as the 30-year fixed-rate mortgage moved up more than half a percentage point, marking the largest one-week increase in our survey since 1987. These higher rates are the result of a shift in expectations about inflation and the course of monetary policy. Higher mortgage rates will lead to moderation from the blistering pace of housing activity that we have experienced coming out of the pandemic, ultimately resulting in a more balanced housing market.

Information provided by Freddie Mac.

- « Previous Page

- 1

- …

- 77

- 78

- 79

- 80

- 81

- …

- 104

- Next Page »